Crypto prices today reflect a market that is regaining confidence as major assets continue to build strength across spot and derivatives markets.

Bitcoin and Ethereum are both trading higher, aided by the rise in volume and the improved technical backdrops.

This increase in focus also brings to the fore infrastructure projects based on usage, such as Remittix (RTX), which is picking up pace based on rising payment transactions.

The broader theme across crypto prices today is not short-term speculation but steady accumulation and improving liquidity conditions. Market participants are watching how these trends develop as the year begins.

Bitcoin Advances as Volume Confirms Breakout Attempt

Bitcoin Advances as Volume Confirms Breakout Attempt

Bitcoin is currently trading at $94,118.04, a significant gain of 2.34% in the past 24 hours, with a market value of $1.87 trillion and a trading volume of $44.71 billion, up 63.62% from the previous level. This places Bitcoin in a prominent position in the Crypto Prices Today ranking.

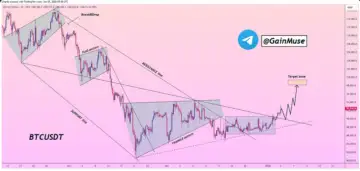

According to a recent market update shared by GainMuse, Bitcoin is attempting to flip prior resistance into support, a move that often signals continuation when volume confirms. The current structure shows a compression base forming from a broader triangle, with buyers defending the breakout zone.

According to a recent market update shared by GainMuse, Bitcoin is attempting to flip prior resistance into support, a move that often signals continuation when volume confirms. The current structure shows a compression base forming from a broader triangle, with buyers defending the breakout zone.

Technical focus remains on whether Bitcoin can hold above reclaimed levels. A sustained move below this area would weaken the setup, while continued strength keeps upside momentum in play. The analysis was shared publicly via this CoinMarketCap community post, which outlines the key technical zones traders are tracking.

Within Crypto Prices Today, Bitcoin’s rising volume is a notable signal, suggesting renewed participation rather than thin, short-lived price action.

Within Crypto Prices Today, Bitcoin’s rising volume is a notable signal, suggesting renewed participation rather than thin, short-lived price action.

Ethereum Price Holds Key Levels as Structure Stays Constructive

Ethereum price movements have been similar to the above, as ETH is currently trading at $3,198.93, representing a 24-hour increase of 2.67%. Market capitalization has reached $388.44 billion, while trading volume jumped 64.87% to $21.62 billion. These moves reinforce Ethereum’s role alongside Bitcoin in shaping crypto prices today.

Market analysis by Vlad Anderson points out that Ethereum has recovered the $3,000 mark and broken through the resistance points of $3,050 and $3,120. The price sustains above the $3,100 area and the 100-hour moving average, thanks to the prominent indication of the bullish trend line.

Market analysis by Vlad Anderson points out that Ethereum has recovered the $3,000 mark and broken through the resistance points of $3,050 and $3,120. The price sustains above the $3,100 area and the 100-hour moving average, thanks to the prominent indication of the bullish trend line.

Strong resistance is pegged between $3,200 and $3,250, with further resistance opening up in case these levels are broken. Support is still pegged at $3,120, followed by $3,050 and $3,000.

Within Crypto Prices Today, Ethereum’s behavior suggests controlled consolidation rather than exhaustion, keeping traders focused on continuation scenarios.

Within Crypto Prices Today, Ethereum’s behavior suggests controlled consolidation rather than exhaustion, keeping traders focused on continuation scenarios.

Remittix Gains Attention as Utility-Focused Volume Builds

As Crypto prices today highlight strength in Bitcoin and Ethereum, attention is also shifting toward projects tied to real financial use. Remittix is increasingly mentioned alongside these market moves due to its focus on crypto-to-fiat payments and live product delivery.

The price of the RTX token is at $0.119 per token, with more than $28.6 million in private funds raised, as well as over 695 million tokens allocated.

The Remittix Wallet is now available in the Apple App Store, and users can now use it to store, send, and manage their crypto assets. The beta testing of the wallet has been extended to more iPhone users. A Google Play release is already in progress, keeping the rollout aligned with published milestones.

The

to go live on 9 February 2026, integrating crypto-to-fiat payouts directly into the wallet. This addresses a long-standing gap in the market by enabling users to move crypto into bank accounts through a single interface.

Remittix has also confirmed future centralized exchange listings, with BitMart and LBank named as upcoming partners once listing timelines are activated. These announcements followed key funding milestones and reflect structured expansion rather than speculative timing.

A major trust signal arrived recently as the Remittix team became fully verified by CertiK and ranked #1 for pre-launch tokens on the platform. This places Remittix among a small group of payment-focused crypto projects with public security validation.

What’s Anchoring Remittix’s Growth Story:

- Wallet is live on the Apple App Store, and an Android release is underway.

- PayFi platform launch is confirmed for February 9, 2026.

- Crypto-to-fiat payments are built for direct bank payouts.

- The CertiK team has completed the verification process and achieved a top pre-launch ranking.

- Ongoing beta wallet testing with community participation

Remittix also operates a referral system that pays 15% rewards in USDT, distributed through its dashboard. A short-term 200% token bonus has generated a huge influx of buying as people look to take a share in one of the most exciting launches of 2026. Remittix beta wallet testing is expanding to more iOS holders.

Where Market Momentum Meets Real Usage

Crypto Prices Today show a market that is leaning back toward structure, volume, and usable infrastructure. Bitcoin’s push toward $94,000 and Ethereum Price stability near $3,200 reflect renewed confidence at the top of the market. At the same time, projects built around payments and financial access are gaining relevance as activity increases.

Remittix sits at that intersection, offering a working wallet, a defined PayFi launch timeline, and a clear focus on crypto-to-fiat transfers. With RTX trading at $0.119, private funding exceeding $28.6 million, and verified security credentials, Remittix continues to position itself as a utility-driven project aligned with broader market momentum.

As crypto prices today continue to evolve, the connection between major assets like Bitcoin and Ethereum and supporting payment infrastructure is becoming harder to ignore.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

FAQs

1. What is the driving strength in Crypto Prices Today?

Crypto Prices Today are supported by rising trading volume, improving technical structure, and stronger participation across Bitcoin and Ethereum. Buyers are defending key levels, which keeps short-term momentum constructive.

2. Why is Bitcoin approaching the $94,000 level?

Bitcoin is trading higher due to increased volume and a successful move above prior consolidation zones. Market structure suggests buyers are attempting to turn former resistance into support.

3. Why is Remittix being discussed alongside Bitcoin and Ethereum?

Remittix is gaining attention because it focuses on real crypto-to-fiat payments, an area that becomes more relevant as on-chain activity increases. Its wallet is live on the App Store, with a full PayFi platform scheduled for launch on 9 February 2026.

4. What makes Remittix stand out among utility-focused crypto projects?

Remittix combines a live wallet, the upcoming PayFi release, CertiK team verification, and over $28.6 million raised through private funding. The RTX token is priced at $0.119, with ongoing beta testing expanding to more users.