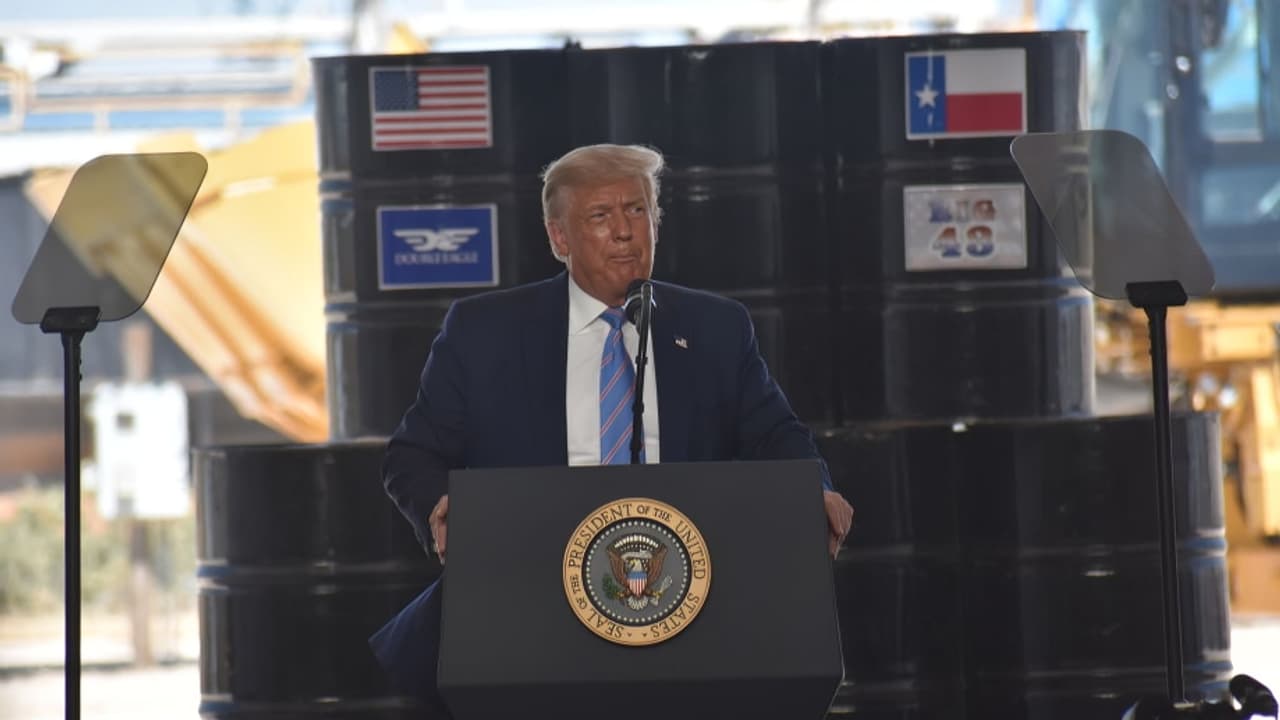

<p><strong>Crude oil traded at $66.31 per barrel on February 20, slipping slightly but staying near a six-month high. Prices gained over 9% in a month due to rising geopolitical tensions, falling US inventories, and supply concerns.</strong></p><img><p>Crude oil fell slightly to $66.31 per barrel on February 20, 2026, down 0.13% from the previous day. The data is based on a contract for difference (CFD) that tracks the benchmark crude market. Over the past month, prices have risen 9.39%, showing strong short-term momentum. However, oil remains 5.80% lower than a year ago. Historically, crude oil recorded an all-time high of 410.45 in December 2025, according to Trading Economics report.</p><img><p>WTI crude oil traded around the $66 level on Friday. The market is close to a six-month high and is heading for a weekly gain of about 5%. Analysts say rising geopolitical tensions and tightening supply conditions are supporting prices.</p><p>A key trigger has been a warning by Donald Trump, who set a deadline of 10-15 days for Iran to make progress on a nuclear agreement. The ultimatum has increased uncertainty in global energy markets.</p><img><p>The United States has deployed its largest military presence in the Middle East since the 2003 Iraq invasion. This development has raised concerns that tensions could lead to a broader and longer conflict. Investors fear any escalation could disrupt oil supply from the region.</p><p>There is particular concern about the Strait of Hormuz, a vital passage through which nearly 20% of the world’s crude exports move. Analysts warn that any restriction of shipping through this route could sharply reduce supply and push prices higher.</p><img><p>Geopolitical risks are not limited to the Middle East. The breakdown of peace talks between Russia and Ukraine in Geneva has raised fears of extended sanctions and supply disruptions. These developments have added a risk premium to oil prices.</p><p>Meanwhile, joint naval drills between Iran and Russia in the Gulf region have further heightened market anxiety.</p><img><p>Supply data has also supported the rally. Government figures showed US crude inventories dropped by 9 million barrels last week, the sharpest fall since early September. Falling stockpiles in both the United States and China suggest demand remains firm.</p><p>Despite planned output increases by OPEC+, the market still appears tight. Analysts say the combination of lower inventories and geopolitical risks is keeping prices elevated.</p><h3><strong>Outlook</strong></h3><p>Market watchers say crude oil prices may remain volatile in the coming weeks. Much will depend on diplomatic developments, supply routes in the Gulf region, and global demand trends.</p>