Citigroup lowered its price target on the stock to $42 from $47, noting that the company reset fiscal 2026 expectations well below estimates, while acknowledging that the first quarter began in a “deep traffic hole” due to the logo mishap.

Cracker Barrel Old Country Store (CBRL) shares declined 3% in early trading on Thursday after multiple Wall Street analysts trimmed their price target on the stock, noting a decline in traffic following the company’s controversial logo change in late August.

Citigroup lowered the firm’s price target on Cracker Barrel to $42 from $47 and maintained a ‘Sell’ rating, according to TheFly. The company reset fiscal 2026 expectations to well below estimates, acknowledging that the first quarter began in a “deep traffic hole” due to the logo mishap.

Cracker Barrel reverted to its old logo in August following a week-long controversy over its new logo that drew outrage from President Donald Trump as well. Last week, the company announced that it would suspend remodeling of restaurants to retain the “Old Timer” logo.

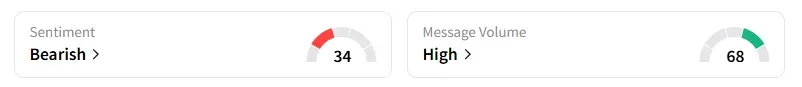

Retail sentiment on Cracker Barrel dipped to ‘bearish’ from ‘bullish’ territory a day ago, with chatter at ‘high’ levels, according to data from Stocktwits. The retail message count also jumped nearly 500% over 24 hours as of Thursday morning on Stocktwits.

Piper Sandler also cut its price target on Cracker Barrel to $49 from $56 and maintained a ‘Neutral’ rating, while Bank of America lowered its price target to $42 from $48 and maintained an ‘Underperform’ rating.

Bank of America noted that stronger fiscal fourth-quarter restaurant comparable growth was “overshadowed by the recent uproar” around the company’s logo change and store prototype test.

CFO Craig Pommells said during the post-earnings call that traffic for the first half of August was down about 1%. Since August 19, the date of the initial logo change, traffic has declined approximately 8%.

Cracker Barrel said that it expects fiscal 2026 total revenue to be between $3.35 billion and $3.45 billion, compared with estimates of $3.52 billion, according to data from Fiscal AI.

Truist Securities trimmed its price target on Cracker Barrel to $58 from $62 and recommended a buy based on the weakness, citing its view that the core drivers of the brand’s turnaround remain intact and that sales may start to recover from the rebranding and the resumption of Fall Menu marketing.

Shares of Cracker Barrel have declined by nearly 7% and fallen 20% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<