Heavy capital spending, data center delays, accounting scrutiny, and waning AI enthusiasm have weighed on CoreWeave’s shares, even as retail traders stay bullish and analysts still see meaningful upside.

- Operational and execution risks have come into sharper focus, with data center construction delays, revised timelines, and infrastructure bottlenecks raising concerns.

- Financial pressures continue to weigh on sentiment, as heavy capital expenditure, a reduced forward outlook, and a speculative credit rating underscore the company’s high-risk, high-reward profile.

- Retail traders and several Wall Street firms continue to bet on a rebound driven by long-term demand for AI.

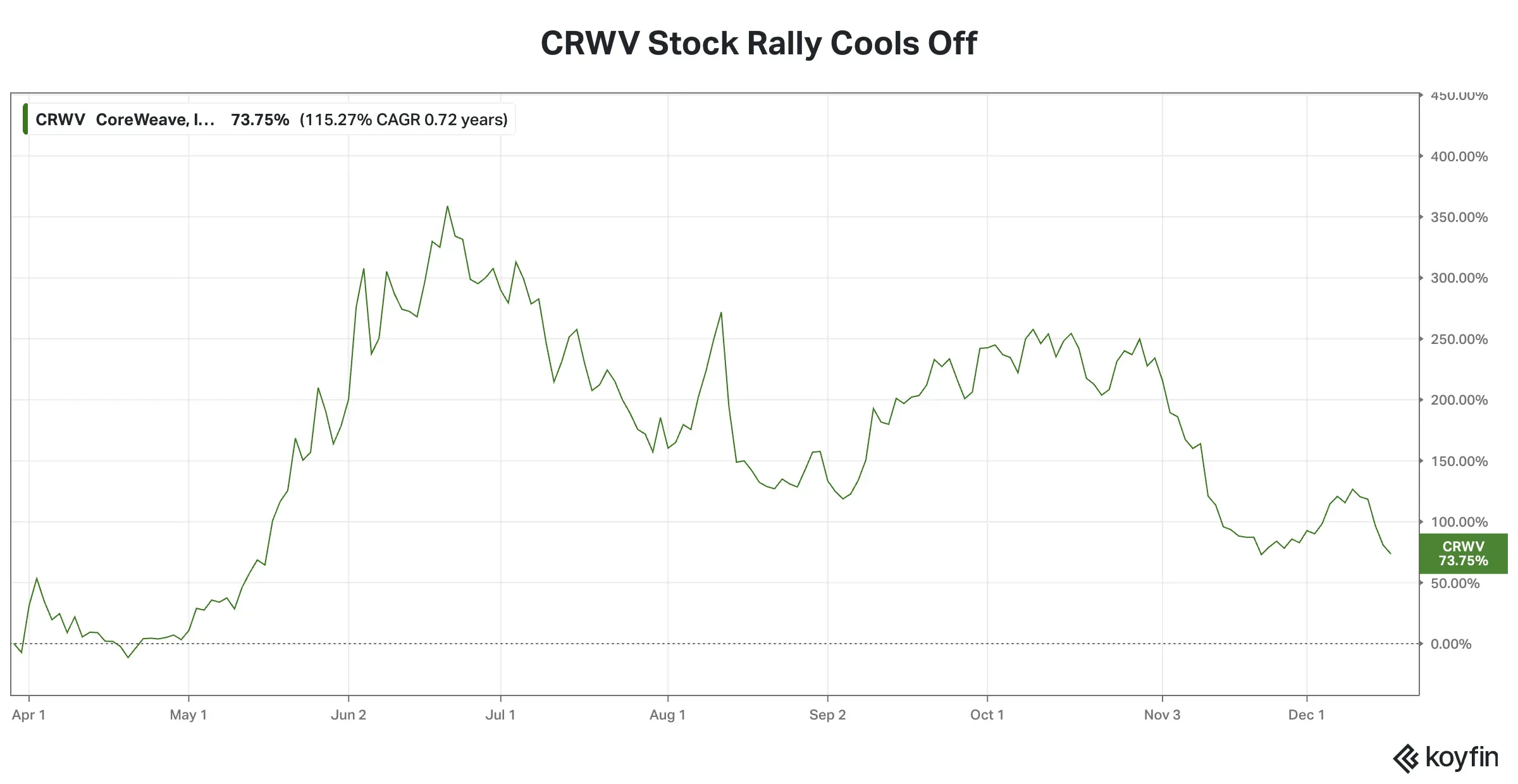

Artificial intelligence (AI) datacenter operator CoreWeave, Inc.’s (CRWV) fortunes have quickly reversed. From a high-profile initial public offering (IPO) in March this year and a meteoric two-month rally that kicked off in late April, CoreWeave’s stock has lost much of its momentum as skeptics sowed doubt in investors’ minds, who were going all in on any AI play.

Even so, the stock is still sitting on handsome gains. What has changed is that much of the nearly 370% return it generated at its intraday peak in late June has evaporated, leaving loyal investors wondering whether the heydays will return.

Source: Koyfin<

What Precipitated the Down Move

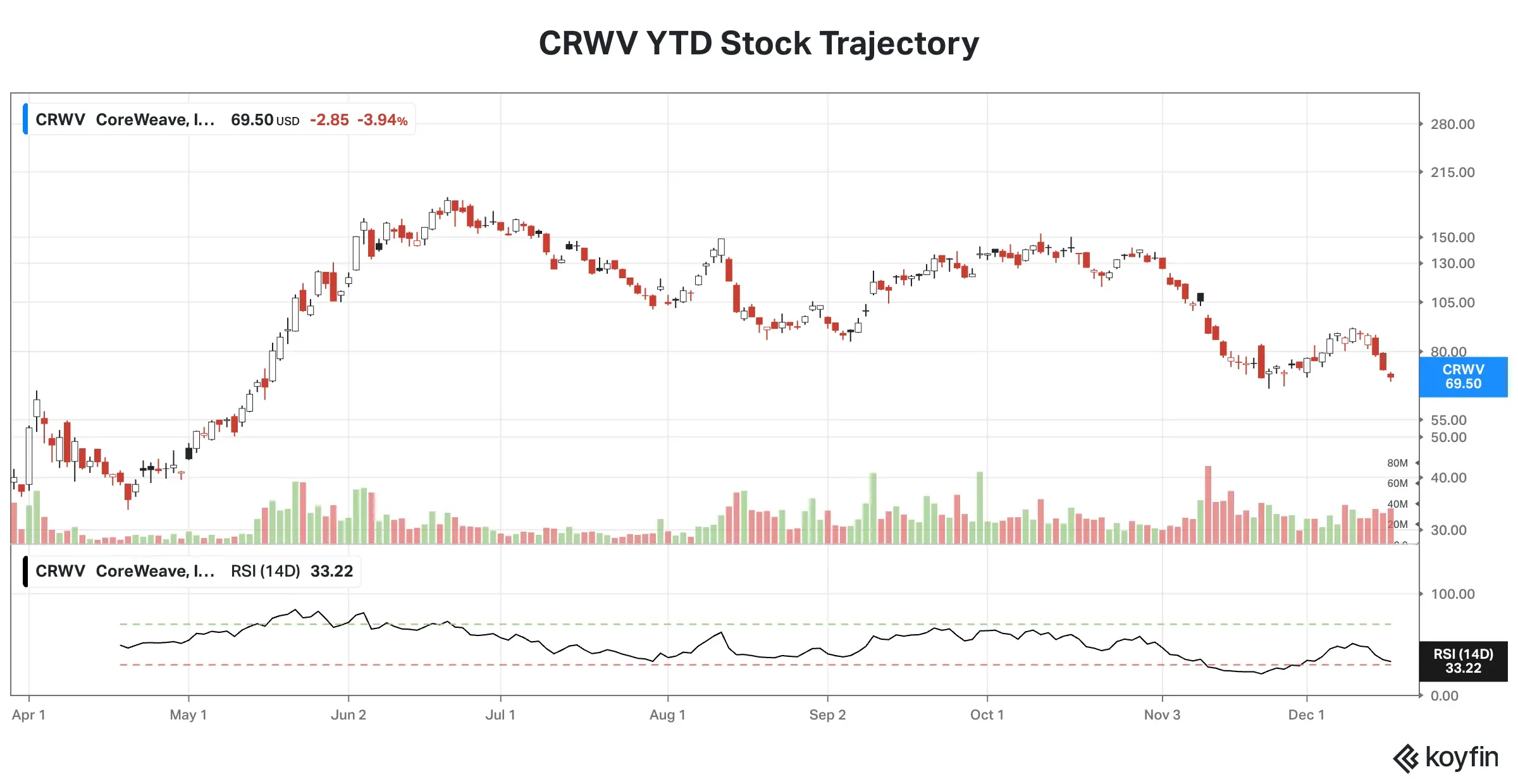

CoreWeave’s hot post-IPO rally stalled after the stock hit a peak in late July. As investors paused for a breather, the Michael Intrator-led company spooked investors by announcing a $9 billion all-stock deal to buy Bitcoin miner Core Scientific, which had also branched out into AI data centers. The agreement has since then been shelved. An expanded AI cloud deal with OpenAI, valued at up to $4 billion, helped to reverse the downtrend. The rally attempt fizzled out in mid-August despite second-quarter results that outperformed expectations. Some blamed the stock slide on the bigger loss it reported for the quarter.

After a modest recovery from the post-earnings slide, CoreWeave moved sideways, before the third-quarter earnings report, released in early November, triggered another round of selling in the stock. A delay in the data center infrastructure coming online prompted the company to reduce its forward-looking guidance, exerting downward pressure on the stock.

Following the Q3 report, Macquarie analyst Paul Golding, who remains on the sidelines of the stock, cut the price target to $115 from $145. The analyst attributed the action to the use of a lower valuation multiple to reflect the persistently high capital expenditure (capex). He, however, sees room for earnings improvement.

Capex, however, declined in the third quarter due to delays at a third-party data center developer, pushing the delivery timeline for “powered shell” capacity.

| Q1’25 | Q2’25 | Q3’25 | |

| Capex | $1.9B | $2.9B | $1.9B |

Data source: Earnings call transcript<

The losses were exacerbated by the AI pessimism that was beginning to grip the market around that time. The recovery seen since late November proved short-lived, and the stock has been in a five-session losing streak since Dec. 9.

Source: Koyfin<

CoreWeave now has 41 data centers, with eight of them coming online in the third quarter. The data center capacity corresponds to 90 megawatts of active power and 2.9 gigawatts of contracted power, according to an S&P report. The firm sees looming risks if the company faces construction or performance issues arising from the data center infrastructure, potentially coming online later than planned.

S&P rated CoreWeave’s $2.25 billion 1.75% senior unsecured convertible notes, due 2031, a ‘B’ — suggesting speculative or junk grade. The Recovery Rating is ‘5,’ indicating a low probability (30%) of recovery.

Delays Dent Progress?

In an exclusive report published on Tuesday, the Wall Street Journal said unexpectedly turbulent rainstorms in North Texas caused a roughly 60-day delay at a construction site in Denton.

The data center cluster, with 260 megawatt computing capacity, which CoreWeave planned to lease to OpenAI, is now pushed back several months, the report said. It is also noted that revised design plans have delayed some of the data center projects that one of the company’s partners was building for it in Texas and elsewhere.

Short Attack

Following the Q3 report, short seller Jim Chanos piled on misery to the stock by questioning the company’s accounting practices, including its use of a longer depreciation period. Even with a longer depreciable life, CoreWeave’s third-quarter numbers suggest the company is barely profitable, he said in a post on X.

What Retail Traders Feel About CRWV Stock

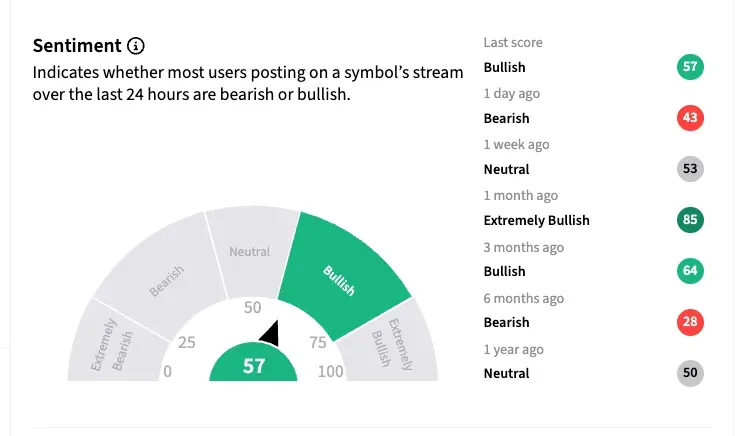

After the stock slump, CoreWeave retail investors have shed their cautious stance and have jumped onto the bullish bandwagon. On Stocktwits, retail sentiment toward the stock was ‘bullish’ as of early Wednesday.

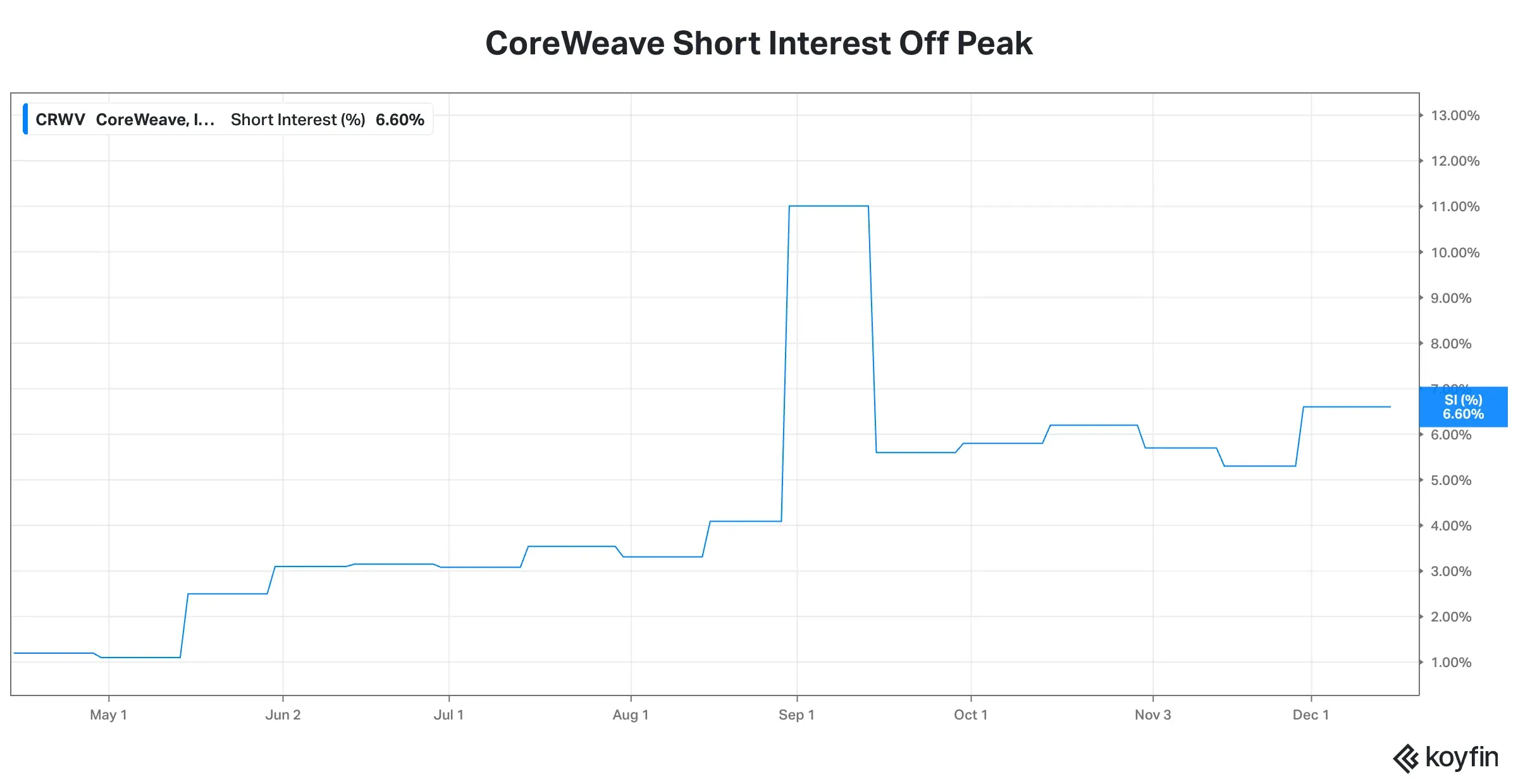

A retail trader hinged his expectations on a potential “V-shaped” recovery in the stock following its five sessions of losses in a row. Another user hoped for a short-covering rally. According to Koyfin, short interest in the stock is elevated at 6.60%, down from the September highs of 11%.

Source: Koyfin<

Source: Koyfin<

More than half of the analysts covering the stock have ‘Buy’ or ‘Strong Buy’ ratings, and 11 remain on the sidelines, and only 2 have sell-equivalent ratings, according to Koyfin’s database. The average analyst price target for the stock is $130.96, implying nearly 90% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<