The company has entered into a new deal with Nvidia under which the chipmaker will be contractually obligated to purchase any leftover cloud capacity that CoreWeave cannot sell to its own customers, through April 13, 2032.

CoreWeave Inc. (CRWV) has entered into a new deal with Nvidia Corp. (NVDA), under an existing long-term agreement by which Nvidia will gain access to CoreWeave’s unused cloud computing resources.

The deal, signed on September 9, stems from a new order form added to the companies’ existing Master Services Agreement (MSA) signed in April 2023. The agreement’s initial value is $6.3 billion.

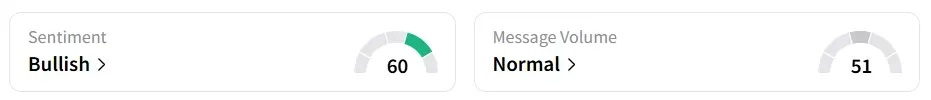

CoreWeave stock traded over 5% higher on Monday morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

A Stocktwits user lauded the development.

Another user highlighted Deutsche Bank’s endorsement of the stock.

Nvidia will now be contractually obligated to purchase any leftover cloud capacity that CoreWeave cannot sell to its own customers, through April 13, 2032.

The structure allows Nvidia to tap into this excess infrastructure as needed, potentially increasing efficiency and reducing resource shortages during periods of peak demand. The MSA will continue until all active orders have either expired or been terminated, or until the agreement is canceled.

Deutsche Bank analyst Brad Zelnick issued a “Catalyst Call: Buy” for CoreWeave as a short-term investment opportunity, according to TheFly. The firm identified several near-term drivers that could propel the company’s revenue and share performance upward, particularly over the next two quarters.

Zelnick points to a strong and growing appetite for AI infrastructure, noting that demand continues to outpace supply. CoreWeave stock has gained over 195% so far since its listing in March.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<