Sentiment turned ‘extremely bullish’ for COMP, with retail traders seeing the knee-jerk drop in shares as a buying opportunity.

A couple of Wall Street analysts have given a thumbs up to Compass’s all-stock deal to acquire rival Anywhere Real Estate, with an expected enterprise value of approximately $10 billion, announced on Monday.

The merger creates an industry leader with 320,000 agents, a 15% share of national sides, and pro forma 2025 revenue of $12.8 billion, according to research firm BTIG, which maintained its ‘Buy’ rating on Compass stock with an $11 price target — implying a more than 38% upside from the last close.

COMP shares climbed 2.2% in extended trading on Monday, a recovery after the knee-jerk investor reaction that dragged shares 15.7% in the regular session.

BTIG noted that the combined entity would benefit from greater scale and volume, while also unlocking an estimated $225 million in cost savings. While Anywhere carries significant debt, BTIG estimates pro forma net debt-to-EBITDA of 4.4x, improving to 1.5x by 2028.

In a separate note, JPMorgan stated that the transaction is good for Anywhere Real Estate shareholders. The stock, expectedly, jumped 45.5% on Monday.

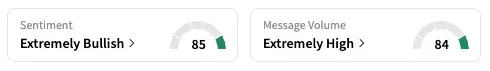

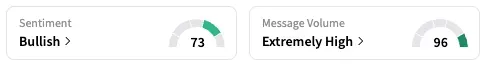

On Stocktwits, the retail sentiment for Compass shifted to ‘extremely bullish’ as of early Tuesday, from ‘bullish’ the previous day, with the 24-hour message volume surging 1,100%. The sentiment for HOUS turned ‘bullish’ from ‘bearish’

Several users noted COMP’s slide as an attractive entry point for the stock, especially in the backdrop of the recent interest rate cut.

Lower interest rates typically bring down mortgage rates, encouraging more home purchases.

“$COMP Perfect entry point!” a user said.

Despite Monday’s drop, Compass shares are up 35.4% year-to-date. Anywhere Real Estate shares have gained 211% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<