CEO Noel Wallace said consumers are showing paycheck-cycle buying patterns, forcing retailers to ramp up promotions.

- Colgate-Palmolive reported an in-line 1.9% growth in third-quarter revenue, with price hikes offsetting soft volumes.

- Management flagged demand weakness, especially in the company’s value-oriented and mid-priced brands.

- The company reported Q3 adjusted EPS above Wall Street targets but lowered its 2025 organic sales growth forecast.

Colgate-Palmolive Co. sparked intense retail-investor buzz late on Sunday as traders discussed their positions for the fresh week following the company’s quarterly report, which was mostly in line with expectations.

The personal care goods company on Friday reported 1.9% revenue growth in the third quarter and earnings per share of $0.91, slightly above estimates. The company, however, lowered its organic sales growth forecast to a 1% to 2% range from its earlier target of 2% to 4%, with management flagging demand weakness, partly offset by price increases.

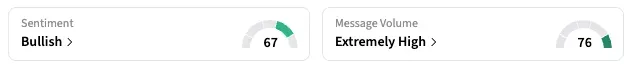

Shares rose 0.7% on Friday, following the results, although they traded near a 52-week low. On Stocktwits, the retail sentiment climbed a few points in the ‘bullish’ zone as of late Sunday over the previous day.

Users on the platform discussed whether the gains were justified despite softer volumes and declining profit (net profit declined by $2 million to $735 million), and some noted that recent share weakness provided a good setup to buy the shares.

“$CL came in today to short and now I’m a bull,” a Stocktwits user posted on Saturday.

On Friday, Colgate-Palmolive CEO Noel Wallace said on the analyst call that sales of the company’s value-oriented and mid-priced brands had pulled back, with buyers “exhibiting behavior consistent with purchasing around paycheck cycles.”

Wallace also pointed to an increase in promotions on the post-earnings call as companies try to encourage inflation-weary shoppers to spend. “As we’ve seen some volume slowdown in the categories in which we compete, I think all the retailers and all the competitors are looking for solutions in order to drive more turn and more velocity in store,” he said, adding that the market continues to show a clear split between high- and low-end products.

The company increased prices by 2.3% across its portfolio, offsetting the impact of lower volumes. To combat ongoing headwinds, Wallace said the company is leaning on innovation and AI-driven productivity improvements, emphasizing faster product development, digital marketing, and automation to improve efficiency and responsiveness to consumer demand.

CFRA slashed its price target on CL by $5 to $88, maintaining its ‘Hold’ rating, while HSBC lowered its target on the stock to $88 from $92, according to MT Newswires.

As of the last close, the CL stock is down 15.3% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<