Gemini CEO Tyler Winklevoss, Kraken Co-CEO Arjun Sethi, and Polymarket CEO Shayne Coplan remain from the previous committee.

- The list includes several more crypto CEOs and top executives in the prediction market space.

- The group also includes leaders from some of the largest traditional companies and organizations, such as Nasdaq and CME Group.

- CFTC chairman Mike Selig said the move was a bid to develop “clear rules of the road” for the “golden age” of markets.

The Commodity Futures Trading Commission (CFTC) tripled its crypto advisory muscle to 35 leaders on Thursday, including Coinbase’s (COIN) Brian Armstrong, Ripple’s (XRP) Brad Garlinghouse and Robinhood (HOOD) CEO Vlad Tenev.

Armstrong has been a leading voice on crypto regulation since 2021 and has been deeply involved in the recent stalemate between the crypto industry and officials in Washington over the CLARITY Act.

The ‘Golden Age’ Of Markets

With the CLARITY Act in limbo and GENIUS regulations yet to be finalized, the CFTC chairman Mike Selig just stacked its advisory group with new names in a bid to future-proof the markets and develop ”clear rules of the road” for the “Golden Age of American Financial Markets.”

“By bringing together participants from every corner of the marketplace, the IAC [Innovation Advisory Committee] will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” Selig added.

More Crypto CEOs Join Regulatory Table

Bullish (BLSH) CEO Tom Farley, Kalshi’s Tarek Mansour, and Uniswap Labs CEO Hayden Adams are also a part of the new cohort. Gemini (GEMI) CEO Tyler Winklevoss, Kraken Co-CEO Arjun Sethi, and Polymarket CEO Shayne Coplan remain from the previous committee.

The list also includes several additional crypto CEOs and top executives in the prediction market space, as well as leaders from some of the largest traditional companies and organizations, such as Nasdaq and CME Group.

The Markets Don’t Seem To Care

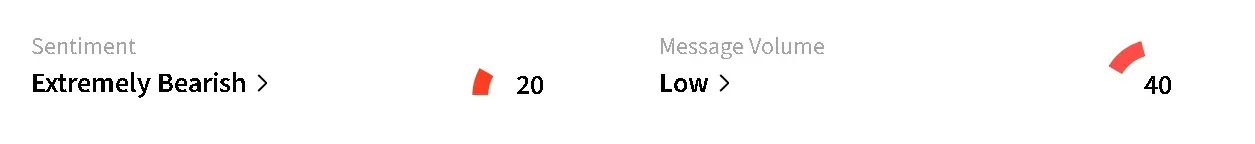

The news does not seem to have lifted the crypto market or crypto-linked equities as of Friday morning. Even XRP’s price didn’t get a bump, down 1.5% in the last 24 hours to $1.36. On Stocktwits, retail sentiment around the token fell into ‘extremely bearish’ territory from ‘bearish’ a day ago.

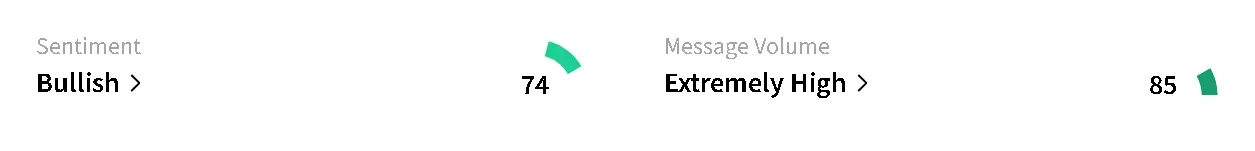

HOOD’s stock edged 0.18% higher after hours after clocking a three-day losing streak in regular hours. Retail sentiment around the company fell to ‘bullish’ from ‘extremely bullish’ territory, while chatter remained at ‘extremely high’ levels amid Cathie Wood’s buying spree after the company’s reported earnings earlier this week.

She’s also been loading up on BLSH shares after the company’s earnings, having spent over $60 million in a 10-day buying spree. The stock edged 0.93% lower in after hours trade following a dip of 0.53% in the regular session.

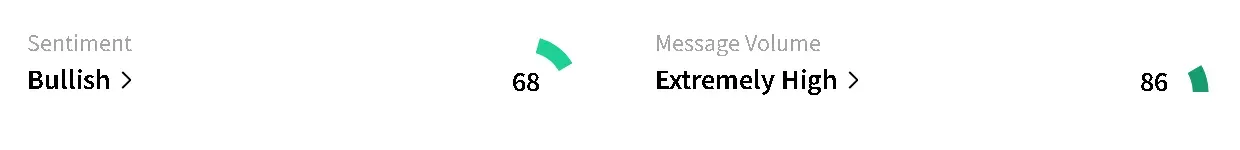

Crypto exchange Coinbase’s stock rose 1.54% after hours, defying the broader weakness in the market, after it reported a 21% dip in revenue as compared to last year in the fourth quarter. COIN was among the top trending tickers on Stocktwits at the time of writing. Retail sentiment around the company was in ‘bullish’ territory, while chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

The overall cryptocurrency market fell by around 1%, staying above $2.3 trillion. Bitcoin (BTC) was down 1.3% with the market watching if BTC’s price would slip under $66,000 ahead of the consumer price index (CPI) report on Friday morning.

Read also: Bitcoin Unlikely to Deliver 500x Returns, Grayscale Chairman Says – But These 2 Privacy Tokens Could Outperform

For updates and corrections, email newsroom[at]stocktwits[dot]com.<