Analyst Lloyd Byrne at Jefferies raised Chevron’s price target to $189 from $174 before and maintained a ‘Buy’ rating.

- Jefferies expects Chevron to report adjusted earnings per share (EPS) of $1.45, or about 2% higher than consensus.

- Analyst Byrne expects investors to focus on developments in Venezuela, TCO (Tengizchevroil) production in Kazakhstan, an update on the El Segundo fire, and the gas-to-AI outlook.

- Chevron is expected to report its fourth-quarter (Q4) 2025 earnings on Jan. 30, 2026.

Jefferies has hiked Chevron Corp.’s (CVX) price target on expectations of the company to report earnings higher than street consensus.

Analyst Lloyd Byrne at the firm raised Chevron’s price target to $189 from $174 before and maintained a ‘Buy’ rating on the shares, according to TheFly.

Jefferies expects Chevron to report adjusted earnings per share (EPS) of $1.45, or about 2% higher than consensus, as per the note. Chevron is expected to report its fourth-quarter (Q4) 2025 earnings on Jan. 30, 2026.

Shares of CVX rose over 2% on Wednesday at the time of writing.

Future Insights

Byrne expects investors to focus on developments in Venezuela, TCO (Tengizchevroil) production at the Tengiz field in Kazakhstan, an update on the El Segundo crude oil fire, and the gas-to-AI outlook.

U.S. President Donald Trump’s push for American oil majors to boost oil production from Venezuela has propelled market interest in related companies, including Chevron, which is currently the only major American oil company still operating in Venezuela.

Last year, Chevron’s 50%-owned affiliate TCO began oil production at the Future Growth Project (FGP) in Kazakhstan, marking a major expansion that is expected to boost output by about 260,000 barrels per day and ramp total production toward 1 million barrels of oil equivalent per day. The company said the milestone would materially increase free cash flow and deliver long-term economic benefits.

The company is also expected to provide an update on the fire that occurred at its El Segundo refinery in Oct. 2025.

Oil Boost

As per a Bloomberg report, U.S. intervention in Venezuela is likely to boost crude output in the country by roughly 50% in the next decade, according to industry consultant Enverus. Production is likely to touch about 1.5 million barrels a day by 2035, as per the report.

Meanwhile, oil prices have been gaining on the back of rising geopolitical tensions including supply disruption fears from a potential U.S. attack on Iran as well as production cuts.

How Did Stocktwits Users React?

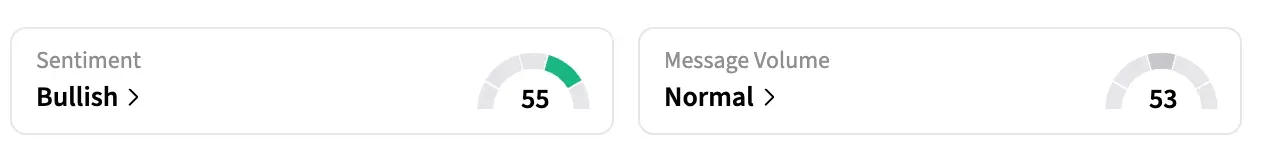

On Stocktwits, retail sentiment around CVX stock remained in the ‘bullish’ territory over the past day amid ‘normal’ message volumes.

Shares of CVX have gained 6.49% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<