The investment research firms say that both restaurant chains are seeing market-share gains.

Goldman Sachs upgraded its rating on Darden Restaurants, Inc.’s stock to ‘Buy’ from ‘Neutral’ and initiated coverage with Cava Group, Inc.’s shares with a ‘Neutral’ rating, according to the investor note summary published on The Fly Monday morning.

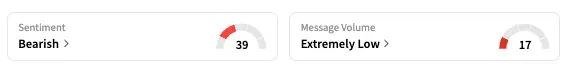

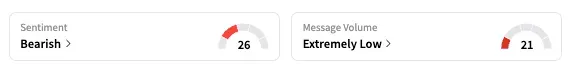

On Stocktwits, the retail sentiment was ‘bearish’ for DRI as well as CAVA as of early Monday. Darden’s is nearly flat year-to-date, while Cava’s stock has declined 44.6%.

The investment research firm set a $225 price target on Darden stock, implying a 20% from the stock’s last close. Goldman Sachs analysts see Darden gaining market share given its lower skew towards lower-income consumers. The company offers “compelling value and scale” at its Olive Garden and LongHorn divisions, emerging as key beneficiaries of accelerated middle-income quintile pre-savings cash flow growth in 2026, they said.

Goldman, meanwhile, placed a $74 price target on shares of the Mediterranean-style restaurant, forecasting a 17% upside.

The firm sees a “robust” long-term growth potential for Cava with market share gains and an “attractive” return profile, but added that there were uncertainties with near-term same-store-sales growth amid a tough macroeconomic backdrop. As such, Goldman advised investors to look for a better entry point to become more constructive on the stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<