Between 2026 and 2028, JPMorgan projected double-digit percentage growth in Caterpillar’s Energy and Transportation segment.

Caterpillar, Inc. (CAT) stock gained 4.5% on Tuesday, logging the best daily gain since May, after JPMorgan turned bullish on the industrial firm on growth prospects for its power generation business.

The brokerage raised the price target for the stock to a street-high of $650 from $505 per share and kept a ‘Buy’ rating. The new price target implied a 28.8% upside compared to the stock’s closing price on Monday.

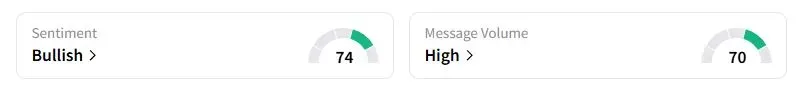

Retail sentiment on Stocktwits about Caterpillar was in the ‘bullish’ territory at the time of writing, while retail message volume jumped 200%.

“We estimate a potential for greater than $10 incremental earnings per share in the base case over the next three years, with capacity constraints the gating factor,” JPMorgan analyst Tami Zakaria reportedly said.

U.S. power demand is growing at the fastest pace since World War II, driven by the power-hungry data centers of companies like Meta, Amazon, and OpenAI. According to a report by Deloitte, power demand from AI data centers in the United States is expected to grow more than thirtyfold, reaching 123 gigawatts, up from 4 gigawatts in 2024.

In August, Caterpillar signed an agreement with Joule Capital Partners to provide four gigawatts of total energy to an upcoming data center in Utah, through Caterpillar’s latest G3520K generator sets and support equipment.

“From our perspective, the most important metric to watch in the Q3 print is the backlog, given the intra-quarter Joule and Hunt data center agreement announcements,” the brokerage said.

The power unit is part of Caterpillar’s Energy and Transportation segment, which generated second-quarter sales of $7.8 billion, contributing to the company’s total of $16.6 billion. Between 2026 and 2028, JPMorgan projected double-digit percentage growth in the segment.

Caterpillar stock has risen 44% this year, outperforming the benchmark S&P 500 and Nasdaq indices. The world’s largest mining and construction equipment maker is scheduled to post third-quarter earnings in the coming weeks.

According to Fiscal.ai data, the industrial heavyweight is expected to post earnings of $4.54 per share for the quarter ended Sept. 30. Last week, Truist analysts wrote in a broader sector note that machinery is facing risk to margins in the second half relative to the first half, as tariff impact will likely show up fully.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<