Canara Robeco AMC IPO: The initial public offering (IPO) of Canara Robeco Asset Management Company (AMC), which sailed through on the third and final day of bidding today, October 13, closed with a healthy demand led by massive subscription from the institutional investors.

The ₹2123-crore Canara Robeco AMC IPO received bids for 33,99,83,168 shares as against 3,48,98,051 shares on offer, as per data from BSE, translating into a subscription status of 9.74 times.

The quota reserved for the qualified institutional buyers (QIBs) was booked the most at 25.92 times. Non-institutional investors (NIIs) followed suit with 6.45 times bids. Meanwhile, the retail quota was booked 1.91 times at the end of the bidding period today.

Canara Robeco AMC IPO GMP

The healthy demand was visible despite a declining grey market premium (GMP). Canara Robeco AMC IPO GMP today dipped to ₹7.5 from a high of ₹35. At the prevailing GMP, Canara Robeco AMC IPO listing price could be ₹274, signalling a premium of over 3%.

Grey market premium signals investor willingness to pay over and above the IPO price.

Canara Robeco AMC IPO Details

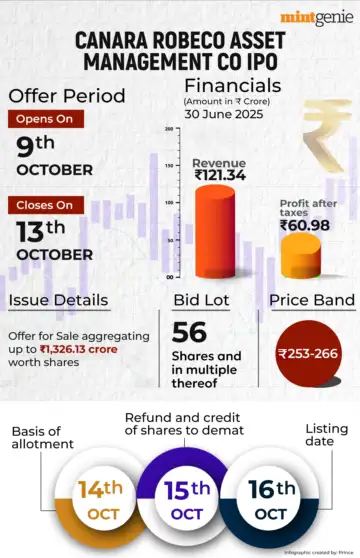

Canara Robeco AMC IPO, which ran from October 9 to October 13, had a price band of ₹253-266 per share.

Investors could apply for the Canara Robeco AMC IPO in lots of 56 shares. The minimum amount of investment required by a retail investor was ₹14,896.

Canara Robeco, a joint venture between India’s Canara Bank and the European arm of Japan’s ORIX, is the smallest among its listed peers by revenue, which include HDFC AMC, Nippon Life India AMC, and UTI AMC, as per a PTI report.

The IPO is entirely an offer for sale by Canara Bank, which plans to sell a 13% stake, and ORIX, which is offloading 24.5% of its holding. The company is not issuing any new shares in this IPO, with the proceeds going entirely to the existing shareholders.

Canara Robeco AMC IPO shares are expected to list on October 16.