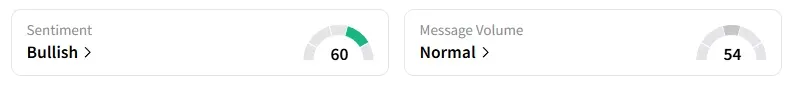

Technical charts indicate a bullish trend, with retail sentiment remaining firmly positive.

Canara Bank shares surged over 3% on Tuesday after its subsidiary, Robeco Asset Management Company, received approval from the capital markets regulator, Securities and Exchange Board of India (SEBI), on its revised draft prospectus for the upcoming initial public offering (IPO). Over the past month, this PSU bank stock has rallied 19%.

“Canara Robeco Asset Management Company Limited, a subsidiary of Canara Bank, has received approval from SEBI for UDRHP (herein referred to as ‘Updated Draft Red Herring Prospectus’) on September 29, 2025,” the bank said in an exchange filing on Tuesday.

The Canara Robeco Asset Management Company (AMC) IPO is an entirely Offer-for-Sale (OFS) of approximately 4.98 crore equity shares. In this IPO, no fresh capital is being raised by the AMC itself; instead, the existing promoters (Canara Bank and ORIX Corporation Europe NV) will sell their shares.

Canara Bank will sell approximately 2.59 crore shares, and ORIX will offer around 2.39 crore shares, reducing their respective stakes. Canara Bank currently holds 51% ownership in the AMC, with ORIX holding the remaining 49%.

This move paves the way for India’s second-oldest asset management company to list on the exchanges without increasing its capital.

Canara Robeco Asset Management Company filed preliminary papers with the SEBI on April 24 this year. SBI Capital Markets, Axis Capital, and JM Financial manage the IPO.

Canara Bank: Technical Outlook

Canara Bank stock has seen a clean breakout on its weekly and monthly charts. SEBI-registered analyst Sunil Kotak highlighted that the Relative Strength Index (RSI) stood at 60, with the stock surpassing its recent highs set in June this year. Overall bias for the PSU bank sector also remained positive, he added.

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for three months now.

Canara Bank shares have risen 24% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<