Short-term trade depends on breakout levels, but fundamentals and corporate loan pipeline support medium-term growth, according to analysts.

Canara Bank shares have risen over 2% on Wednesday, tracking gains in the broader PSU bank sector.

Earlier in the week, analyst Deepak Pal had flagged that Canara Bank stock appeared to be in a neutral to slightly bullish phase on the daily chart. Its Relative Strength Index (RSI) stands around 60, indicating moderate strength without overbought conditions. He added that overall technical indicators lean toward a neutral buy rating.

In the short term, Pal expects Canara Bank to trade with caution and range-bound movement. It needs a clear breakout above near-term resistance or a retention above recent support to trigger a further upside. He advised short-term traders to watch for consolidation and look for potential buying opportunities around support levels.

Over the medium-to-long term, he added that strong fundamentals are visible in earnings. The bank also expanded its rural footprint by sponsoring the newly formed Karnataka Grameena Bank, boosting regional presence post-RRB consolidation.

For catalysts going ahead, he advised investors to monitor the corporate loan pipeline (₹50,000–55,000 cr), rate movements on fixed deposits and MCLR, and its upcoming earnings report by the end of October.

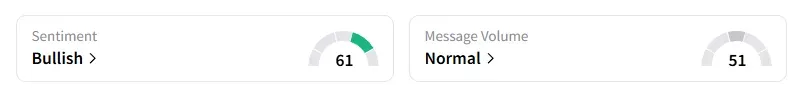

What Is The Retail Mood?

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago.

Canara Bank shares have risen 11% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<