Relaxed export rules and increased diversion for ethanol production could partially offset challenges surrounding pricing. Key players like Balrampur Chini and EID Parry remain on investor watchlists

India’s sugar stocks could be headed for a crucial season. The country’s sugar output is projected to rise nearly 18% in 2025-26, even as ethanol faces pricing pressures and the looming threat of tariffs on potential imports.

With the government’s focus on pushing ethanol-blended fuel and cane pricing in focus, the next few months will help determine if the sugar sector can regain its sweet spot.

A few sugar stocks have been gaining traction on investors’ radar from this space. EID Parry (India) has rallied 45% in the last six months, Balrampur Chini, and Dalmia Bharat have clocked in over 25% gains.

Other notable companies include Bajaj Hindusthan Sugar and Shree Renuka Sugars.

Strong Output Forecast

India’s sugar output is projected to surge nearly 18% to 34.9 million tonnes in the 2025–26 season, according to the Indian Sugar and Bio-energy Manufacturers Association (ISMA). Additionally, sugar diverted for ethanol production is expected to rise to 5 million tonnes, compared with 3.5 million tonnes in the current season.

Ethanol from Sugar: The Challenges

Ethanol is made from sugarcane, maize, and grains. It is a clear, colorless alcohol that is commonly used as a blending agent with petrol to reduce vehicle emissions.

In August 2024, the Indian government permitted sugar mills to produce ethanol from cane juice, syrup, and B‑heavy molasses, a byproduct with higher sucrose levels. The move was expected to support the goal of 20% ethanol blending into petrol by 2025‑26.

The original goal of achieving 20% blending (E20) by 2030 was brought forward to 2025 and was met in March 2025. Now the Indian government is aiming to blend 30% ethanol in petrol by 2030.

However, the sugar industry hasn’t yet benefited from the success of ethanol blending as the sector’s share in the national ethanol program has plunged from 73% to 28% in just two years.

Capacity Present, But Not Enough Utilization

India has the capacity to produce 952 crore litres of ethanol per year, with the potential to divert 40 lakh tonnes of sugar. And still, only 32 lakh tonnes are expected to be used this year, which highlights the underutilization in the sector.

The National Federation of Cooperative Sugar Factories (NFCSF) said sugar-based ethanol supply is expected to fall from 369 crore litres in 2022-23 to 250 crore litres in 2024-25, as stagnant ethanol prices lag behind rising sugarcane costs, making direct sugar sales more profitable.

The Tariff Overhang

The ongoing tariff-related challenges could act as another stumbling block.

Last month, the Indian Sugar and Bio-energy Manufacturers Association (ISMA) objected to the proposed talks on permitting ethanol imports under the India-US trade framework, warning that it could hinder payment of the Fair and Remunerative Price (FRP) to sugarcane farmers and result in underutilization of domestic ethanol production capacity.

Sugar Stocks: Mixed Moves In 2025

Using Stocktwits data, we see a mixed 2025 so far for the sugar sector, with retail investors primarily in a wait-and-watch mode. The Nifty Commodities index, by comparison, is up around 8% in the same period.

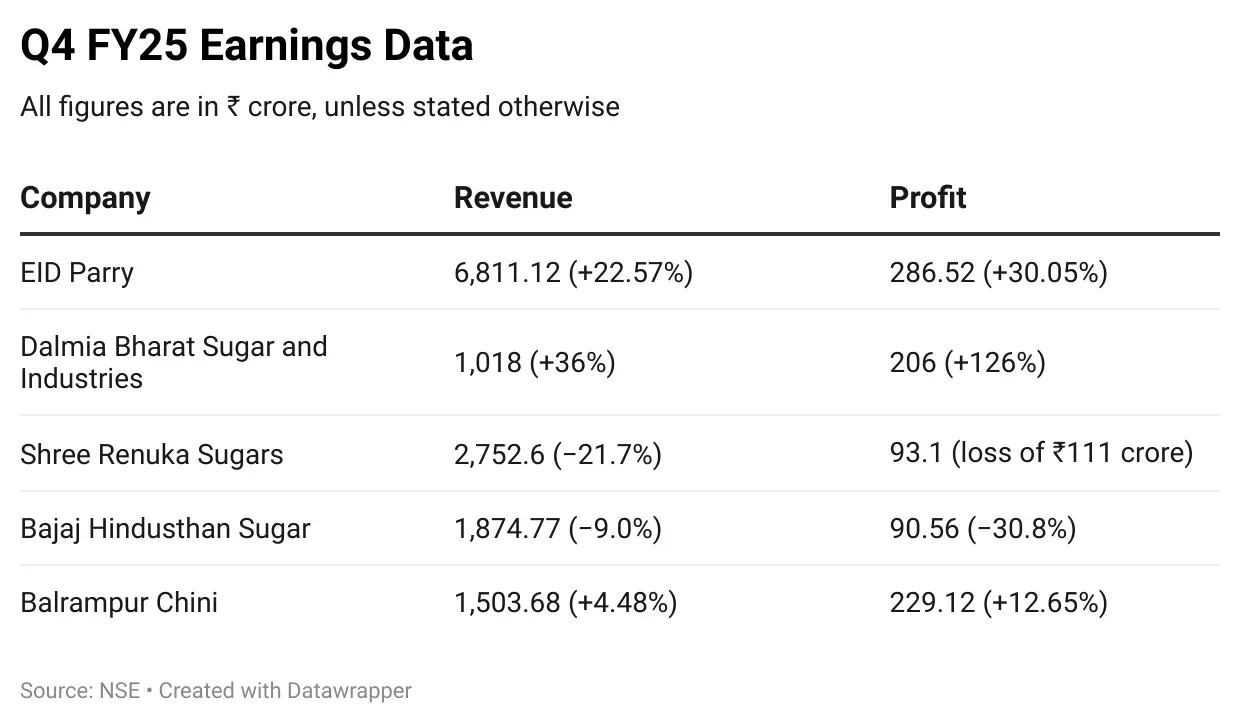

Given below is the Q4 FY25 financial data for five key sugar companies.

The Next Triggers: What Investors Are Watching

Any upward revision in ethanol pricing is likely to boost sentiment for sugar stocks. Additionally, clarity on import pricing for ethanol during the upcoming US-India trade discussions will be crucial.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <