The crypto mining firm’s board approved a 1-for-60 reverse stock split of both its Class A and Class B shares in order to maintain compliance with Nasdaq’s listing requirements.

- The reverse split will take effect at the opening of trading on January 20.

- Post the reverse split, outstanding Class A shares will be reduced to around 1.5 million from 88.6 million.

- Shareholders had approved a reverse split between 1-for-2 and 1-for-200 on Mar. 14, 2025.

Bit Origin (BTOG) shares slumped 32% on Thursday to their lowest in nearly nine months after the crypto mining firm announced a 1-for-60 reverse stock split of both its Class A and Class B shares.

The reverse split will take effect at the opening of trading on January 20, with Class A shares continuing to trade on the Nasdaq Capital Market under the same ticker, the company said.

This comes after shareholders approved a reverse split between 1-for-2 and 1-for-200 on Mar. 14, 2025, giving the board authority to set and implement the final ratio at any time before Mar. 14, 2026. The action is intended to maintain the stock’s compliance with Nasdaq’s listing requirements by meeting the $1 minimum bid price requirement.

Once implemented, every 60 outstanding shares will be consolidated into one share, reducing the outstanding Class A shares from about 88.6 million to around 1.5 million and the outstanding Class B shares from 768,000 to 12,800.

“While the Reverse Stock Split is intended to assist the Company in regaining compliance with Nasdaq Listing Rule 5550(a)(2), the Company cannot assure that it will be able to regain or maintain compliance with Nasdaq’s continued listing standards,” said Jinghai Jiang, Chairman and Chief Executive Officer of Bit Origin.

In late August last year, Bit Origin received a notice from Nasdaq’s Listing Qualifications Department granting the company an additional 180-day extension, pushing its compliance deadline to Feb. 16, 2026.

How Did Stocktwits Users React?

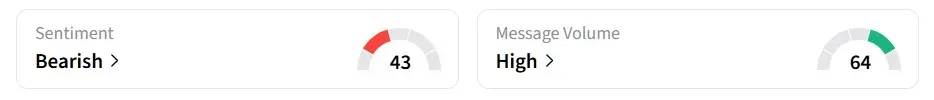

Retail sentiment for BTOG stock remained in the ‘bearish’ territory over the past 24 hours, amid ‘high’ message volumes.

One user had already anticipated the reverse split update.

The company said that as of August 11, 2025, it had around 70.5 million Dogecoin (DOGE) holdings

Read also: GLXY Stock Rallied 10% Today – What Are The Two Factors At Play?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<