Charts suggest possible range breakouts in IGL and Federal Bank, and downside setups in Jindal Steel and KFin Tech.

SEBI-registered analyst Financial Sarthis flagged four stocks – Indraprastha Gas, Jindal Steel, KFin Technologies, and Federal Bank – for a potential breakout or breakdown this week.

While IGL and Federal Bank appear poised for upward momentum, Jindal Steel and KFin Tech could face near-term weakness if key support levels are breached, according to their technical charts. Let’s take a closer look at what they indicate.

Indraprastha Gas (IGL)

Financial Sarthis noted that Indraprastha Gas has been consolidating within the ₹200–₹227 range for several months. Recent trading activity indicates a range breakout attempt, along with huge surge in volumes that confirms strong buying interest in the utilities space. If a 15 or 30-minute candle closes above ₹222, IGL may quickly advance to ₹227 or higher.

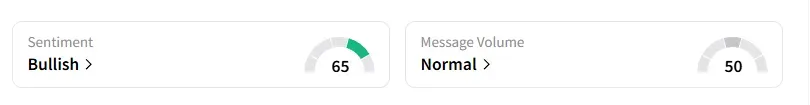

Data on Stocktwits shows retail sentiment is ‘bullish’ on this counter.

IGL shares have risen 6% year-to-date (YTD).

Jindal Steel

The stock is showing signs of a possible flat horizontal breakdown. The increased selling volume over the past two days suggests weakness. If Jindal Steel breaks below ₹1,029 and sustains the break for at least 15 minutes, it could drop to ₹1,019 or even ₹1,000.

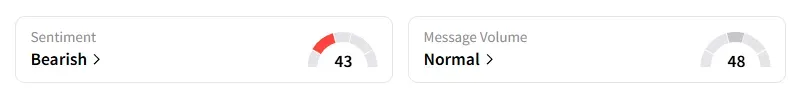

Data on Stocktwits shows retail sentiment has been ‘bearish’ for a month on this counter.

Jindal Steel shares have risen 10% year-to-date (YTD).

https://stocktwits.com/financialsarthis/message/631288557

KFin Technologies

According to Financial Sarthis, KFin Tech appears to be setting up for a potential flat horizontal breakdown. While the selling pressure is controlled, it needs further confirmation on the downside. A sustained move below ₹1,044 could push the stock into the ₹1,020–₹1,025 range.

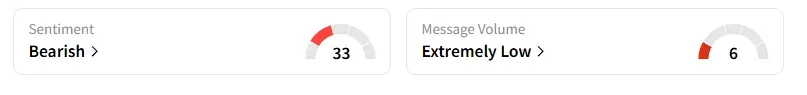

Data on Stocktwits shows retail sentiment has been ‘bearish’ for a month on this counter.

KFin Tech shares have risen 11% year-to-date (YTD).

Federal Bank

Federal Bank stock is showing a possible flat horizontal breakout. A surge in volume indicates robust buying interest, supported by favorable open interest data. With the AVWAP resistance nearby, a decisive break and sustained move above ₹200 could trigger a strong upward rally.

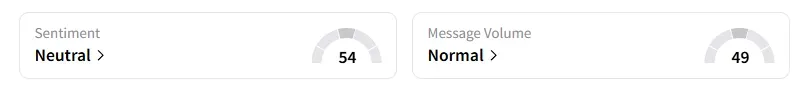

Data on Stocktwits shows retail sentiment is ‘neutral’ on this counter.

Federal Bank shares are flat year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<