Data from Stocktwits showed that retail chatter jumped 157% over 24 hours as of Tuesday morning and more than 1,000% over the past week.

Shares of Bitcoin miner Bitfarms (BITF) soared more than 15% in afternoon trade on Tuesday to hit a more than one-year high of $2.90, marking their sixth consecutive day of gains.

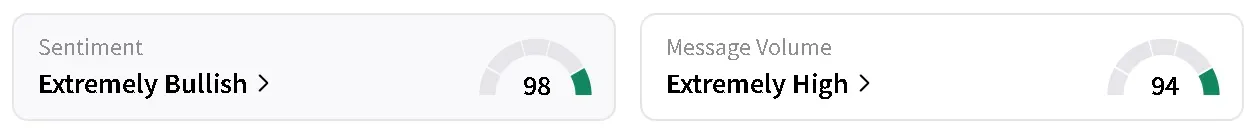

Bitfarm’s stock has more than doubled over the past week, with retail sentiment on Stocktwits trending in ‘extremely bullish’ territory, accompanied by retail chatter at ‘extremely high’ levels over the past day. These are the highest sentiment and chatter levels the stock has clocked on the platform over the past year.

The stock was rallying despite weakness in the broader market. According to Stocktwits data, the retail momentum behind Bitfarms has been building for some time. As of Tuesday morning, message volume had surged 157% over 24 hours, 1,024% over the past week, and increased 7,320% in the past month, according to platform data.

One retail trader predicted that Bitfarms’ stock is likely to hit $4 sometime soon.

Another said that Tuesday’s rally may have set the new support level at $2.80.

The rally began last week after Nebius Group announced a five-year agreement to supply Microsoft (MSFT) with $17.4 billion worth of GPUs, a deal aimed at bolstering Microsoft’s artificial intelligence infrastructure. The news fueled enthusiasm for companies with large-scale computing power, including Bitcoin (BTC) miners.

Bitfarms has also benefited from broader industry tailwinds. Bitcoin mining power topped one zetahash earlier this week, strengthening network security but also raising mining difficulty—a dynamic that favors larger, well-capitalized operators.

Bitfarms’ pivot into high-performance computing (HPC) and AI infrastructure has also drawn investor attention. In its second-quarter (Q2) results, the company reported an 87% year-over-year jump in revenue tied to that strategy and unveiled plans to expand its U.S. footprint with a second principal office in New York City.

Bitfarms’ stock has gained 81% this year and 42% over the last 12 months.

Read also: Bitcoin, Ethereum Trade Cautiously Ahead Of Fed Meeting – Congress To Weigh BTC Reserve

For updates and corrections, email newsroom[at]stocktwits[dot]com.<