Bitdeer’s move to eliminate its Bitcoin treasury comes after a week of refinancing activity and capital raises, as the miner navigated a balance sheet including $1 billion in borrowings.

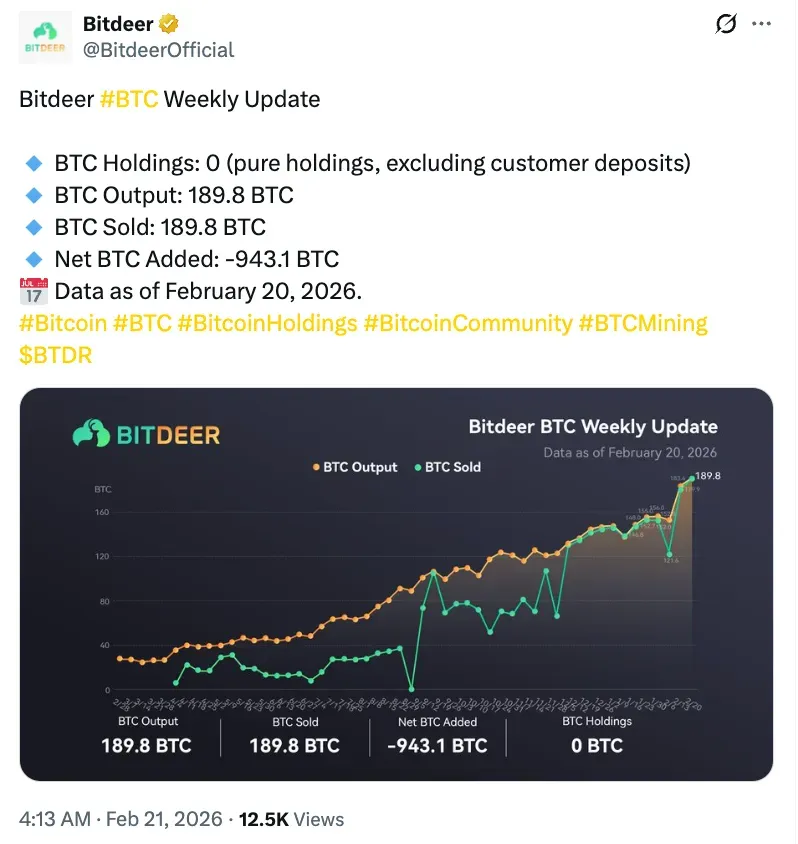

- Bitdeer disclosed in its Friday weekly update that it had sold all its Bitcoins, having produced and sold 189.8 during the period.

- The company recently priced a $43.7 million registered direct share offering and announced a convertible notes package of up to roughly $315 million.

- In its Q4 earnings call, Bitdeer reported $149.4 million in cash and equivalents and $1 billion in borrowings, excluding derivative liabilities.

Bitdeer Technologies Group (BTDR) said on Friday that it no longer owns any Bitcoin (BTC) after selling 189.8 BTC. This came two days after the company announced a $43.7 million share offering and a convertible notes financing package.

In its BTC Weekly Update on X, Bitdeer reported that it had 0 BTC holdings, excluding customer deposits. The company produced 189.8 BTC during the reporting period and sold the same amount, resulting in a net BTC addition of negative 943.1 BTC.

Bitdeer Technologies Group (BTDR) shares closed at $7.78, down by 2.02% on Friday, before rising 1.15% to $7.87 in after-hours trading. Over the past year, BTDR shares have fallen more than 40%. On Stocktwits, retail sentiment around BTDR remained ‘extremely high’, accompanied by ‘extremely high’ levels of chatter over the past day.

The disclosure came after activity in the capital markets earlier last week. Bitdeer announced it wants to sell $300 million in convertible senior notes due in 2032 in a private placement. The next day, the company set the price for a registered direct offering of 5,503,030 Class A ordinary shares, raising about $43.7 million.

The company’s press releases say that the proceeds from the notes offering will be used to buy back existing 2029 convertible notes, capped call transactions, and for other business purposes. The cash from the equity offering will likely be used to buy back notes and for other business needs, like working capital.

Bitdeer Capital And Liquidity

Earlier this month, Bitdeer held its fourth-quarter earnings call. During the call, Bitdeer reported $149.4 million in cash and equivalents, $83.1 and $135.6 million in digital assets owed to the company, alongside approximately $1 billion in borrowings, excluding derivative liabilities.

Bitdeer has not stated whether the Bitcoin liquidation reflected a long-term change in its treasury policy. The zero-BTC position came as Bitdeer restructured its capital through equity and convertible debt financing. Although the company has not stated anything related, the restructuring and Bitcoin sell-off after announcing a $1 billion investment suggest it is at risk of running out of cash.

Read also: Robinhood Says Investors View The Bear Market As ‘An Opportunity To Buy The Dip’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<