Bitcoin received the largest share of votes in a Stocktwits poll focused on capital allocation during volatile market conditions.

- Gold trailed Bitcoin by a narrow margin, with many respondents favoring a blended allocation across both assets.

- A notable share of respondents said they would allocate to altcoins instead of Bitcoin or gold.

- Gold prices extended their rally Tuesday night, setting another record high during the session.

Bitcoin (BTC) topped gold as the preferred asset for traders to park capital amid current market volatility, even as gold prices set new highs on Tuesday night.

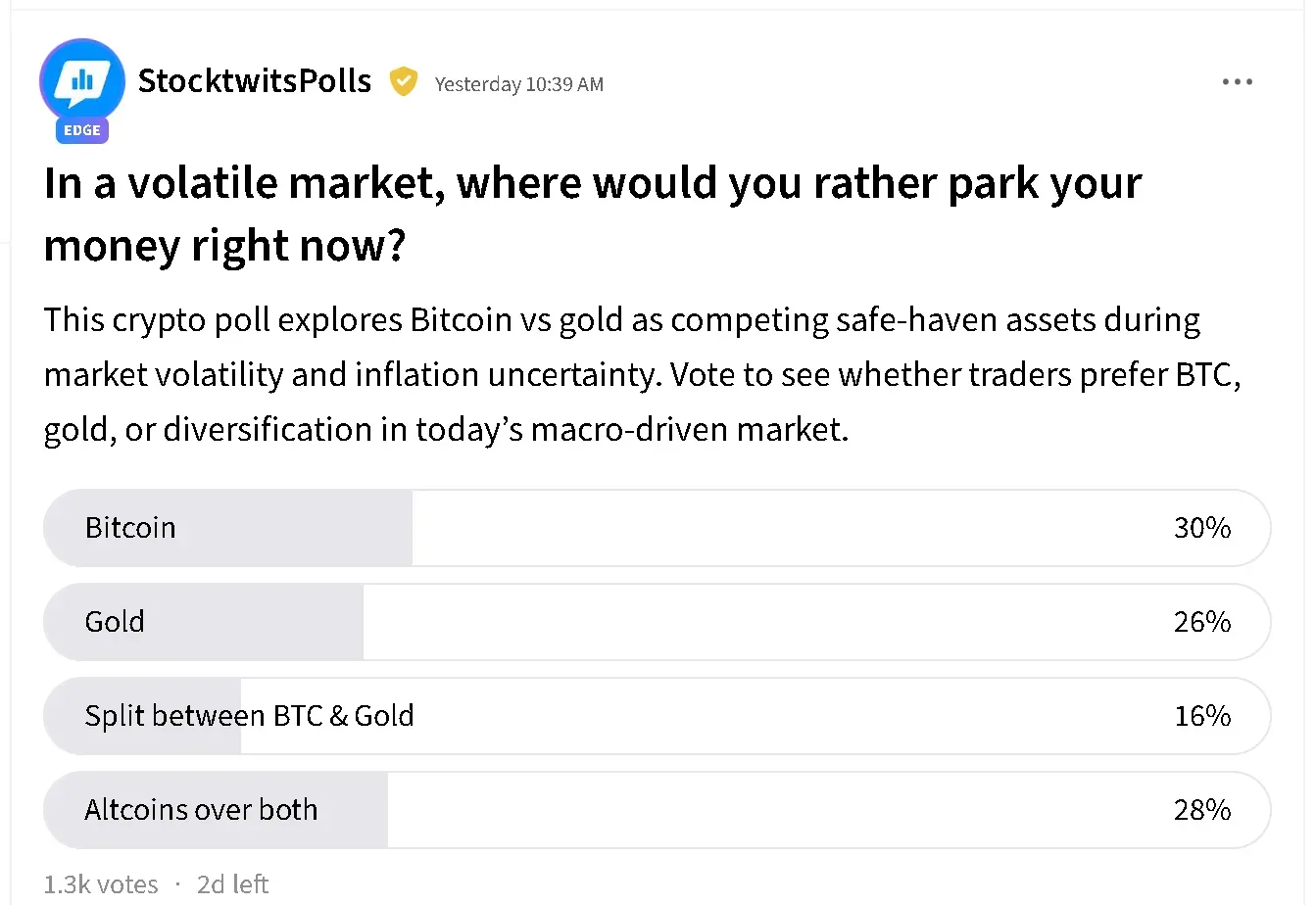

In an ongoing poll on Stocktwits, which asked participants where they would allocate funds in a volatile market environment marked by inflation uncertainty and macro-driven swings, Bitcoin received 30% of the vote, surpassing gold at 26%.

Meanwhile, 16% of respondents favored splitting their allocations between Bitcoin and gold, while 28% said they would rather hold altcoins than either alternative.

Gold Rallies While Bitcoin Stalls

Bitcoin’s price rose 0.8% in the last 24 hours to around $89,000. The apex cryptocurrency remained below $90,000 after plunging to $86,000 over the weekend. On Stocktwits, retail sentiment around BTC fell to ‘extremely bearish’ from ‘bearish’ territory over the past day.

Meanwhile, gold’s price continued to hit higher highs. Spot prices rose nearly 2% over the past day to a record high of $5,283 per ounce, according to TradingView data. The price of silver soared more than 2% to nearly $116 per ounce, but remained below its record high of over $117.5 per ounce seen on Monday.

SPDR Gold Shares ETF (GLD) was among the top trending tickers on Stocktwits at the time of writing. Retail sentiment around the fund trended in ‘extremely bullish’ territory over the past day, accompanied by ‘extremely high’ levels of chatter. The iShares Silver Trust (SLV) also saw retail sentiment in ‘extremely bullish’ territory over the past day, with ‘extremely high’ levels of chatter.

Bitcoin’s Playing Catch-Up

One poll participant said that while they still view gold as a traditional safe haven, its recent rally has pushed prices to what they described as “questionable levels.” The user added that they are stepping away from gold, while continuing to hold Bitcoin and increasing exposure to altcoins.

Another said that Bitcoin is poised for a sharp rally to close the valuation gap with gold.

No More Four-Year Cycle

Bitcoin’s slim lead indicates its growing role in macro-focused portfolio discussions as institutional participation has gained traction over the past year, with more traditional players entering the digital asset market and favorable regulatory momentum under President Trump’s crypto-friendly approach.

According to market watchers like BitMEX founder Arthur Hayes, ARK Investment’s Cathie Wood, Bitmine’s (BMNR) Tom Lee, and Strategy (MSTR) executive chairman Michael Saylor, Bitcoin has broken away from its four-year cycle and is now approaching a ‘supercycle’ that could provide more sustained highs for the apex cryptocurrency.

“We’re kind of bridging the gap between crypto just being a grassroots movement to now Wall Street really participating. And Wall Street is the largest institutional market in the world,” Changpang ‘CZ’ Zhao said at the MENA conference last year in December, also stating that Bitcoin is on the verge of a ‘supercycle’.

Read also: Cathie Wood’s ARK Invest Continues To Load Up On Peter Thiel-Backed Bullish Even After Stock Hits Record Low

For updates and corrections, email newsroom[at]stocktwits[dot]com.<