The apex cryptocurrency was trading at $122,007.82 at the time of writing, while Ethereum dipped to $4,430.76, and XRP fell 1.2% to $2.82, according to CoinMarketCap data.

Bitcoin hovered around the $122,000 mark in early trading on Thursday as investors digested the minutes of the Federal Reserve’s September meeting amid the U.S. government shutdown.

The apex cryptocurrency was trading at $122,007.82 at the time of writing, while Ethereum dipped to $4,430.76, and XRP fell 1.2% to $2.82, according to CoinMarketCap data. Among other tokens, BNB held firm at $1,311.96, while Solana and Cardano rose compared to a day ago.

The Fed minutes showed that there was a slim majority in favor of two 25-basis-point cuts in the FOMC’s October and December meetings. “Participants stressed the importance of taking a balanced approach in promoting the committee’s employment and inflation goals,” the minutes said.

However, they also showed that labor market weakness remained among the top concerns of the central bank, which noted that although the unemployment rate remained low, the pace of employment increases had slowed, and labor market conditions had softened.

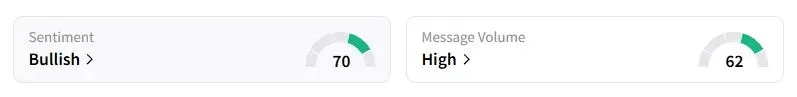

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

After hitting an all-time high of over $126,000, Bitcoin has delved lower due to profit-taking and a rise in the U.S. dollar. The greenback is experiencing its best week in a year, in part due to a decline in the Japanese yen following the change of reign in Tokyo.

Precious metals and cryptocurrencies have benefited over the past week from debasement trade, where investors flee to safe-haven assets amid political instability globally.

“Normally, when the dollar rises, gold falls. Now they rise together. Investors are buying both as safe assets. This doesn’t happen often. It can signal stagflation, high inflation, weak growth, and low confidence,” investor Ted Pillows said.

Is Bitcoin’s Four-Year Cycle dead?

Arthur Hayes, chief investment officer and co-founder of Maelstrom, wrote on Thursday that Bitcoin is unlikely to enter a bear market cycle anytime soon due to favorable monetary conditions, which will put an end to the argument regarding Bitcoin’s four-year halving cycle.

Hayes said in an essay titled “Long Live the King!” that the primary catalyst behind previous bitcoin bear markets in 2014, 2018, and 2022 was the hawkish monetary policy, not the four-year halving cycle. However, the Fed, alongside other central banks, is likely to increase the supply of money in the near future, which is a positive driver for cryptocurrencies.

Citi’s Stablecoin Bet

Separately, Citigroup has invested in stablecoin infrastructure company BVNK, according to a CNBC report. While it did not disclose the amount Citi has invested or the valuation BVNK commanded, Chris Harmse, co-founder of BVNK, stated that its valuation is higher than the $750 million publicly disclosed at its last funding round.

The bet comes at a time when Citi and its peers are rapidly expanding their presence in the cryptocurrency space amid regulatory backing for digital assets in Washington, D.C.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<