Silver retreated sharply after hitting record highs, drawing heavy retail attention on Stocktwits despite the pullback.

- Bitcoin briefly reclaimed the $90,000 level in early trade before paring gains.

- The broader cryptocurrency market rose 1.7% over the past 24 hours, lifting total market capitalization back above $3 trillion.

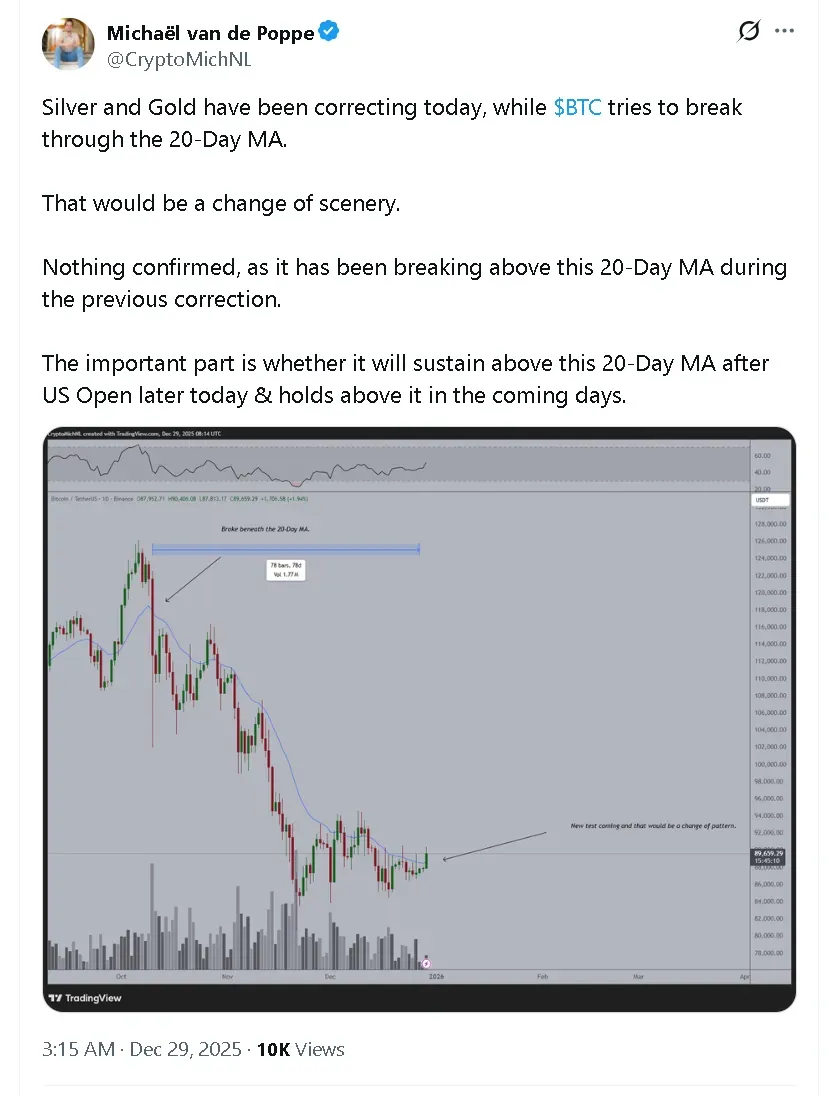

- Michael van de Poppe, co-founder and CIO of MN Capital, said markets were at an inflection point and the outcome would depend on whether Bitcoin can remain above its 20-Day Moving Average.

Bitcoin (BTC) ripped higher in early-morning trade on Monday, extending a weekend recovery, even as silver retreated from record highs and broader precious metals weakened.

Bitcoin’s price recovered to cross $90,000 in the early-morning trade before paring gains to drop back to $89,340 at the time of writing. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

Markets Are At An ‘Inflection Point’

The rebound followed a sharp pullback in silver, which fell more than 5% in early-morning trade after touching a record high above $83.40 per ounce late Sunday, according to TradingView. The iShares Silver Trust (SLV) was the top trending ticker on Stocktwits at the time of writing, with retail sentiment in the ‘extremely bullish’ territory over the past day and chatter at ‘extremely high’ levels.

The iShares Bitcoin ETF (IBIT) was also among the top-trending tickers on the site, up 2.25% in pre-market trading. While retail sentiment around the fund rose to ‘bearish’ from ‘extremely bearish’ territory over the past day, chatter dipped to ‘low’ from ‘normal’ levels.

Michael van de Poppe, CIO and co-founder of MN Capital, said markets were at an inflection point. “Silver and Gold have been correcting today, while BTC tries to break through the 20-Day MA. That would be a change of scenery. Nothing confirmed,” he said, adding that sustainability above the level following the U.S. open would be key.

Crypto Market Reclaims $3 Trillion As Shorts Bear The Brunt

The overall cryptocurrency market rose 1.7% over the last 24 hours, climbing back above $3 trillion. CoinGlass data showed only $177 million in liquidations on the day, with most of the forced unwinds coming from short bets. Long liquidations amounted to $45 million.

ETF flows remained negative during the holiday-shortened week, according to SoSoValue. U.S. spot Bitcoin ETFs recorded net outflows of $782 million, while Ethereum ETFs saw $102 million in outflows over the past week. Solana and XRP products posted inflows of $13.14 million and $64 million, respectively.

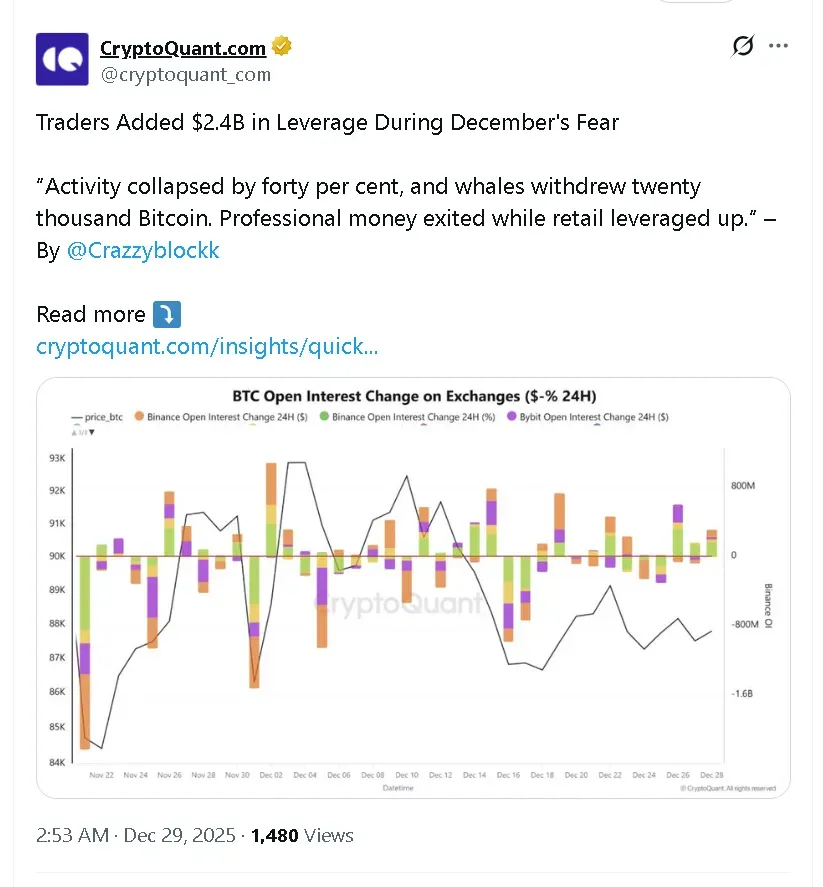

CryptoQuant highlighted renewed risk-taking late last year, noting that traders added roughly $2.4 billion in leverage during December’s period of heightened fear. “Activity collapsed by 40%, and whales withdrew 20,000 Bitcoin. Professional money exited while retail leveraged up,” one CryptoQuant analyst said.

Blockchain tracker Lookonchain also reported renewed whale accumulation, noting that two newly created wallets withdrew a combined 1,600 Bitcoin, worth roughly $143.65 million, from Binance within a three-hour window.

Solana, Ethereum Lead Gains

Solana (SOL) led the early morning surge among major tokens. Solana’s price gained 2.7% over the last 24 hours, trading at $127.60. On Stocktwits, retail sentiment around the altcoin remained in ‘bearish’ territory, but chatter increased to ‘normal’ from ‘low’ levels over the past day.

Solana was followed by Ethereum (ETH), which gained 2.1% to trade just under $3,000 – after hitting the mark earlier during the session. On Stocktwits, retail sentiment around ETH also trended in ‘bearish’ territory, but chatter dropped to ‘low’ from ‘normal’ levels over the past day.

Meme token Dogecoin (DOGE) was also among the lead gainers, up 1.9% in the last 24 hours. Dogecoin’s price was trading at around $0.1262 with retail sentiment on Stocktwits improving to ‘neutral’ from the ‘bearish’ zone over the past day, as chatter rose to ‘normal’ from ‘low’ levels.

Ripple’s native token XRP (XRP) and Binance Coin (BNB) both gained around 1.2% each in the last 24 hours. Cardano (ADA) lagged, edging only 0.2% higher on the day.

Read also: MSTR, BMNR, And Other Crypto-Linked Stocks Slip While Bitcoin, Ethereum Post Weekend Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.<