The liquidation accounted for roughly a quarter of all Bitcoin liquidations over the past 24 hours.

- BlackRock’s BTC sale comes after the iShares Bitcoin Trust saw the highest outflow since its January 2024 debut.

- BlackRock has been the hardest hit by the crypto market sell-off, accounting for $2.1 billion of November’s total withdrawals.

- Spot Bitcoin ETFs are approaching $3 billion in net outflows for November, putting them on track for the weakest month in their history.

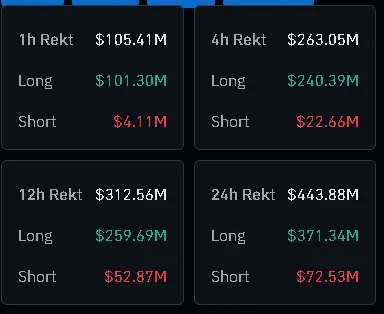

Bitcoin (BTC) fell below $90,000 for the second time this week, wiping out more than $100 million in leveraged positions in just one hour. The liquidation accounted for roughly a quarter of all Bitcoin liquidations over the past 24 hours.

The dip in Bitcoin’s price comes after on-chain data on Arkham showed that BlackRock, the operator of the largest Bitcoin spot ETF (IBIT) in the market, sold off more of the token than ever before. This comes as IBIT recorded the highest ETF outflow since its January 2024 debut.

The iShares Bitcoin ETF fell 3.7% in afternoon trade on Wednesday. On Stocktwits, retail sentiment around the fund remained in ‘bullish’ territory with ‘high’ levels of retail chatter over the past day.

Bitcoin’s price was down 4.5% in the last 24 hours, trading at an intra-day low of around $89,300. Retail sentiment around the apex cryptocurrency trended in ‘bearish’ territory, accompanied by ‘high’ levels of chatter over the past day. In the past 24 hours, more than 162,800 traders were liquidated, according to CoinGlass data.

BlackRock ETF Redemptions Spike

BlackRock’s iShares Bitcoin Trust (IBIT) saw $523 million in net outflows on Tuesday, according to data from SoSoValue. The outflows reflect the ETF’s largest daily redemption since its launch.

Spot Bitcoin ETFs are approaching $3 billion in net outflows for November, putting them on track for the weakest month in their history. BlackRock alone accounted for $2.1 billion of November’s total withdrawals.

IBIT’s operations require BlackRock to buy or sell Bitcoin to match investor demand. When customers buy units on a net basis, BlackRock acquires Bitcoin, and when investors redeem, it sells the underlying token. Large outflows from the firm’s ETF can trigger significant short-term market pressure on Bitcoin.

Read also: Elon Musk Announces xAI, Humain, Nvidia Partnership To Launch 500MW Project In Saudi Arabia

For updates and corrections, email newsroom[at]stocktwits[dot]com.<