The extension delays a significant tariff hike until November, preventing what could have been a virtual trade embargo and keeping rates lower during the crucial holiday import season.

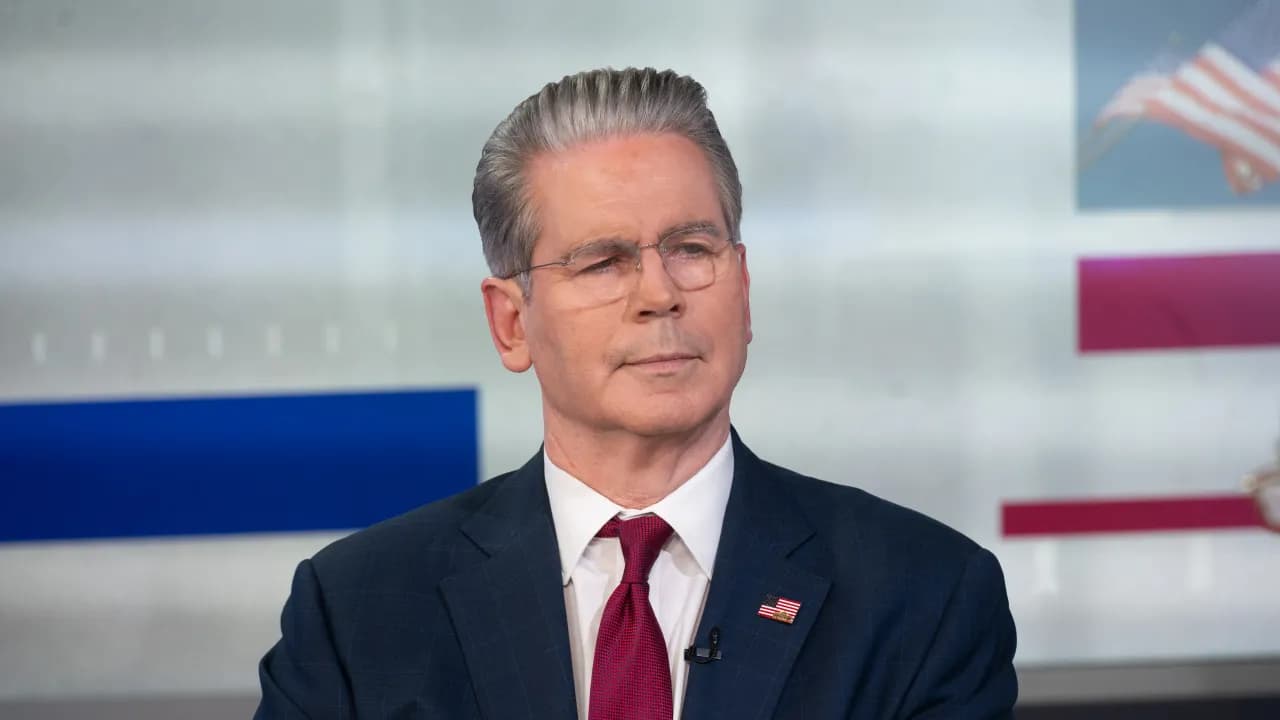

U.S. Treasury Secretary Scott Bessent on Tuesday said the extended tariff truce with China is “working pretty well,” days after both countries agreed to delay a significant escalation in duties until November.

“China is right now the biggest revenue line in the tariff income,” Bessent told Fox News, adding that talks with Beijing have been productive and another round is likely before November.

On Aug. 11, U.S. President Donald Trump signed an executive order extending the tariff truce on Chinese imports until Nov. 10. This kept the duties at 30% as opposed to the levies reverting to 145%.

China’s Commerce Ministry issued a matching pause, holding its tariffs at 10% instead of raising them to 125%. The extension staved off what would have amounted to a virtual trade embargo and ensured lower tariff rates during the critical holiday import season.

The two countries had first agreed to a 90-day truce in May after talks in Geneva, followed by further discussions in Sweden in July.

Washington has also been pressing Beijing to curb Russian oil purchases, though Trump said last week he has no immediate plans for new tariffs in light of ongoing Ukraine peace talks.

Trump recently held a summit with Russian President Vladimir Putin in Alaska and met Ukrainian President Volodymyr Zelenskyy, NATO, and European leaders in Washington. He said Zelenskyy and Putin will meet bilaterally before a trilateral session that would also include him.

Asked whether Budapest could host the trilateral meeting, Bessent said that “could be” the case, though the bilateral meeting must come first.

On Stocktwits, retail sentiment for the SPDR S&P 500 ETF Trust (SPY) was ‘bearish’ with ‘normal’ message volume. The mood toward the Invesco QQQ Trust (QQQ) was ‘extremely bearish’ with ‘normal’ activity, while the iShares MSCI China ETF (MCHI) registered ‘neutral’ sentiment on ‘low’ volume.

So far this year, SPY is up 9.8% and QQQ has gained 11.7%, while MCHI has outperformed both with a 28.4% rise.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<