- Bharat Electronics secured a ₹633 crore contract from Cochin Shipyard.

- Analysts flag a technical breakout above ₹436, potentially opening the path to ₹454–₹475.

- Retail sentiment remains cautious despite a strong 44% YTD gain.

Shares of Bharat Electronics (BEL) edged up 1% on Thursday after the company secured a ₹633 crore order from Cochin Shipyard. The contract covers a wide array of defense tech, including sensors, weapon systems, fire control mechanisms, and communication equipment.

This marks BEL’s third significant order in recent weeks, following ₹592 crore and ₹712 crore deals in September and October, respectively.

According to SEBI-registered analyst A&Y Market Research, the consistent inflow of high-value contracts underscores BEL’s growing dominance in India’s defense electronics space and its pivotal role in naval modernization.

They believe that with a robust order book and strong momentum, BEL remains a stock to watch in the defense sector.

BEL is India’s largest defense electronics company, with an order book of ₹74,800 crore.

BEL: Technical view

A&Y Market Research said that a breakout above ₹436 could open the path toward ₹454–₹475 in the short term. However, a close below ₹408 would weaken the momentum for BEL stock.

BEL: What is the retail mood on Stocktwits?

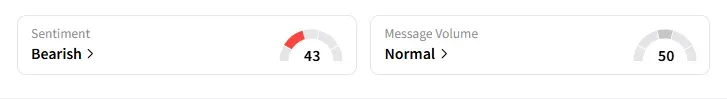

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week on this counter.

Indian defense stocks have had a stellar run in 2025, with BEL shares surging 44% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<