Oracle’s booming AI-cloud orders mask rising concerns over soaring RPO quality, negative free cash flow, heavy leverage, and mounting credit-risk signals that have unsettled Wall Street.

- RPO growth looks inflated as near-term recognizable revenue lags sharply, fueling fears of circular or non-monetizable AI contracts.

- Cash burn has intensified, with free cash flow deeply negative amid massive capex tied to AI-infrastructure expansion.

- High leverage and widening credit-default-swap spreads highlight growing market doubts about Oracle’s financial resilience in an AI-capital-intensive cycle.

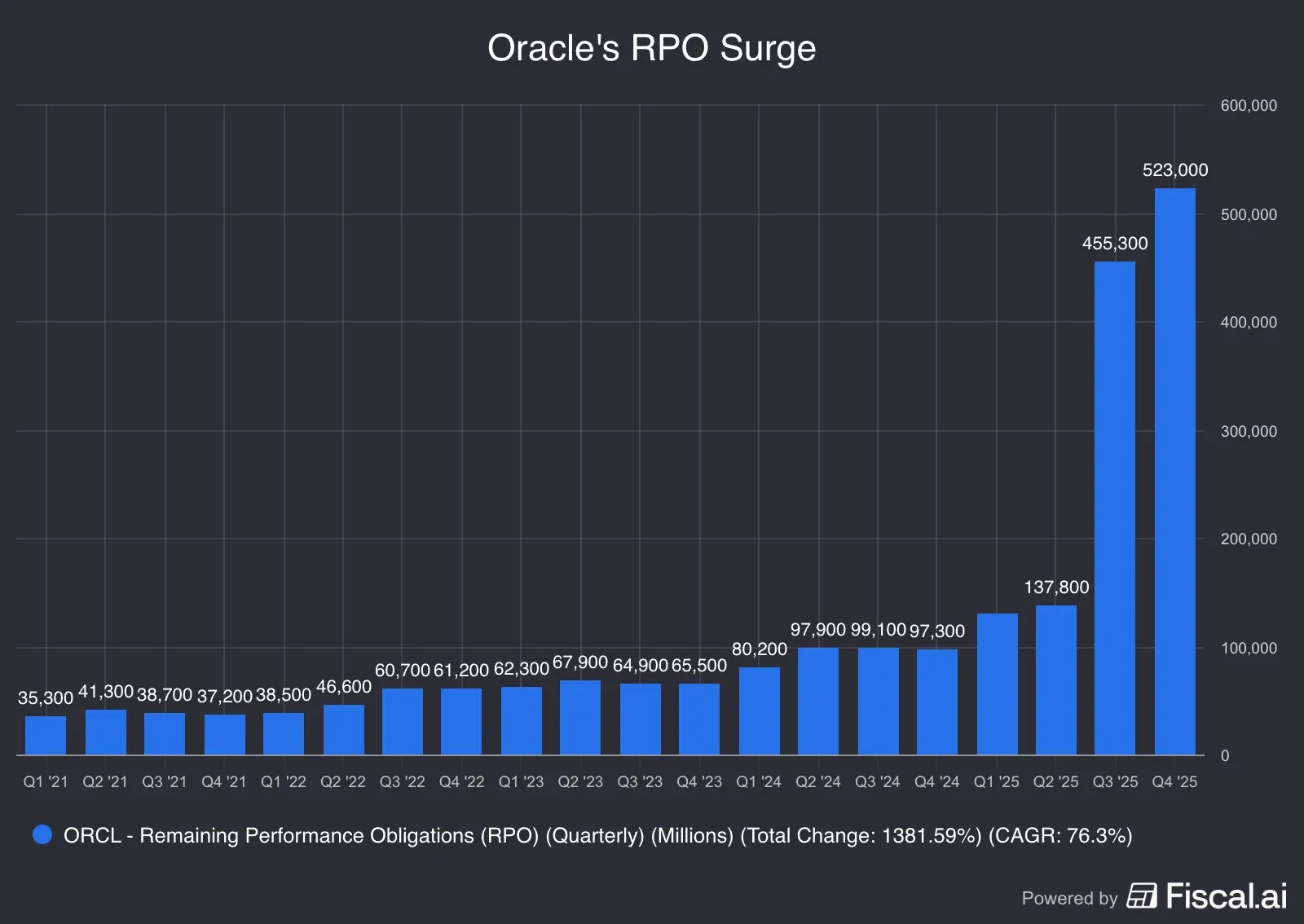

Oracle’s reinvention as an AI-era cloud infrastructure provider is paying off. Its latest quarter delivered another stunner, with remaining performance obligations (RPO) soaring 433% to a colossal $523.3 billion. That’s future revenue locked in.

And these aren’t nebulous contracts. Larry Ellison has heavyweight names — Meta and Nvidia — on the hook. Still, with Wall Street growing wary of circular AI-era deals, investors may squint at numbers this big.

But why the investor jitters? Was a roughly $100 million revenue miss really enough to sour sentiment, or was it simply the spark that ignited deeper concerns?

How Oracle Earns Revenue

Austin, Texas-based Oracle derived roughly half of its fiscal year 2026 second-quarter revenue from its cloud business, with software and services making up 37% and 9%, respectively. Hardware contributed a measly $776 million to the $16.06 billion total.

The $8 billion in cloud revenue Oracle earned in Q2 is split evenly between cloud infrastructure-as-a-service (IaaS) and cloud application or SaaS. The former unit comprises a host of enterprise-grade cloud services, including compute, storage, networking, platform-as-a-service (PaaS) services for databases, analytics, etc.

On the earnings call, Principal Financial Officer Douglas Kehring said cloud infrastructure revenue jumped 66% year over year (YoY), with GPU-related revenue outperforming with a 177% growth clip, according to a transcript provided by Koyfin.

Red Flag #1: Soaring RPO

RPO, a metric that includes invoiced but not earned (deferred revenue), and contracted but not yet invoiced (backlog), has seen a stratospheric climb since Oracle’s fiscal first quarter.

Source: Fiscal.ai<

Oracle’s dependence on a small group of major customers—a classic case of customer concentration risk—continues to cast a shadow over its outlook. Its high-profile alliance with OpenAI has added to that scrutiny. In late September, OpenAI said the late-July agreement to build up to 4.5 GW of capacity amounts to more than $300 billion over five years. The deal falls under the broader, private “Stargate” AI-infrastructure initiative announced by the Trump administration with significant fanfare shortly after the president’s inauguration in January.

The latest earnings report didn’t break out how much of that $523.3 billion in RPO will convert to revenue in the next 12 months. On the call, Kehring noted a 40% growth in 12-month RPO, versus 25% in Q1 and 21% a year ago — a far cry from the 433% surge in total RPO that Oracle highlighted, lending some credibility to those critics who pan it as a ‘Shell Game.’

Adding to the uncertainty is OpenAI’s fragile financial footing. According to internal documents cited by the Wall Street Journal last month, the Sam Altman-led ChatGPT maker expects to rack up $74 billion in losses in 2028 as computing costs soar. Whether a loss-making OpenAI can ultimately meet its financial commitments to Oracle has become the central question.

Red Flag #2: Negative Free Cash Flow

Oracle generated a negative free cash flow (FCF) of $10 billion in Q2. FCF is vital for a company as it represents how much real cash, or spendable cash, is left to cover costs and keep the business running. Technically, it is cash generated from core operations less capital expenditure (capex).

Oracle’s FCF Deep In Red

| Q2’26 | Q1’26 | Q4’25 | Q3’25 | Q2’25 | Q1’25 | |

| FCF | -$13.2B | -$5.9B | -$394M | +$5.8B | +$9.5B | +$11.3B |

| Capex | +$33.5B | +$27.4B | +$21.2B | +14.9B | +$10.8B | +$7.9B |

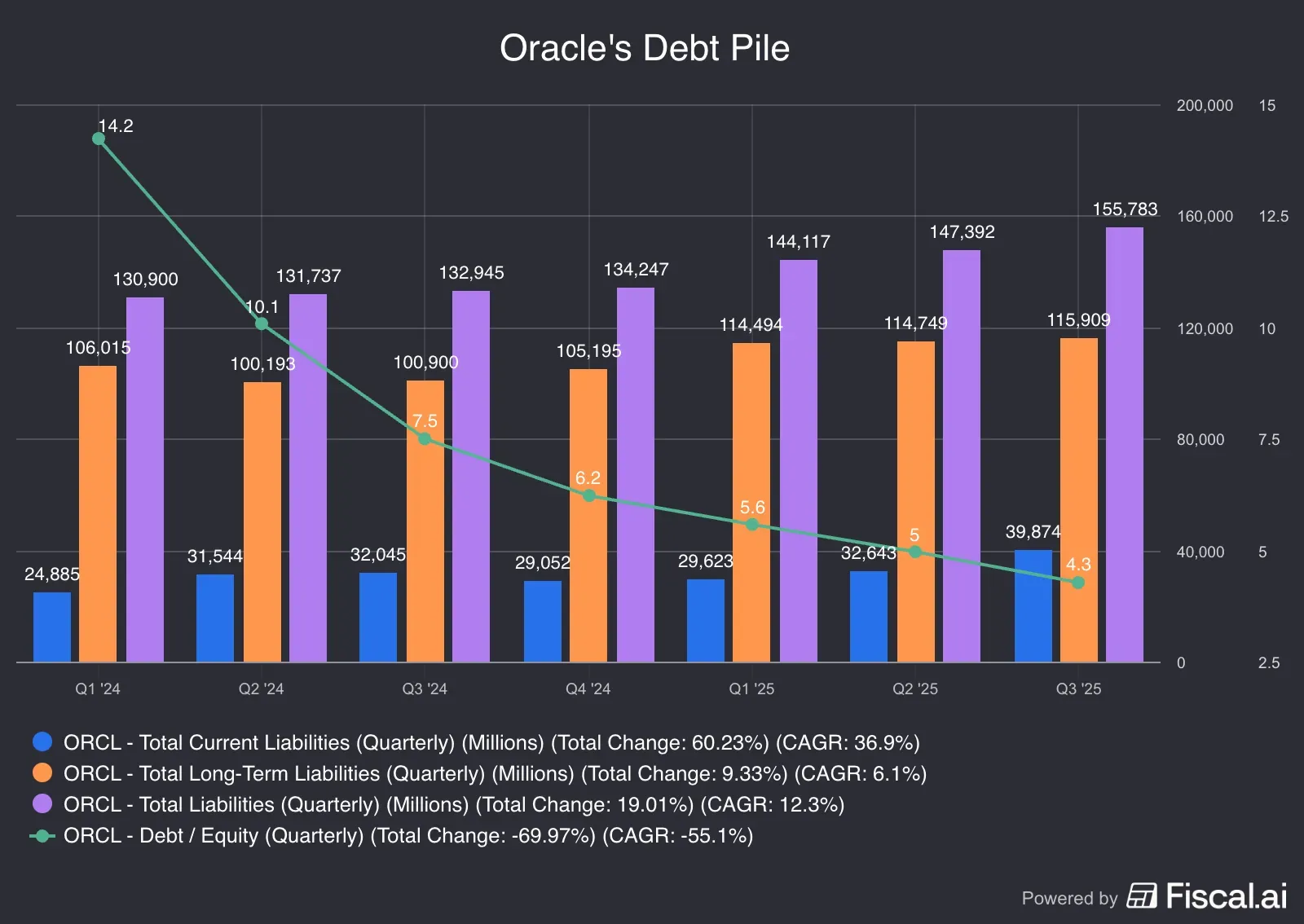

Red Flag #3: Heavy Debt Burden

Oracle’s debt-to-equity ratio, a key measure of financial health, is currently at 4.3 times, meaning it has roughly $4 in debt for $1 in equity, which, by any measure, is significant leverage.

Source: <Fiscal.ai<

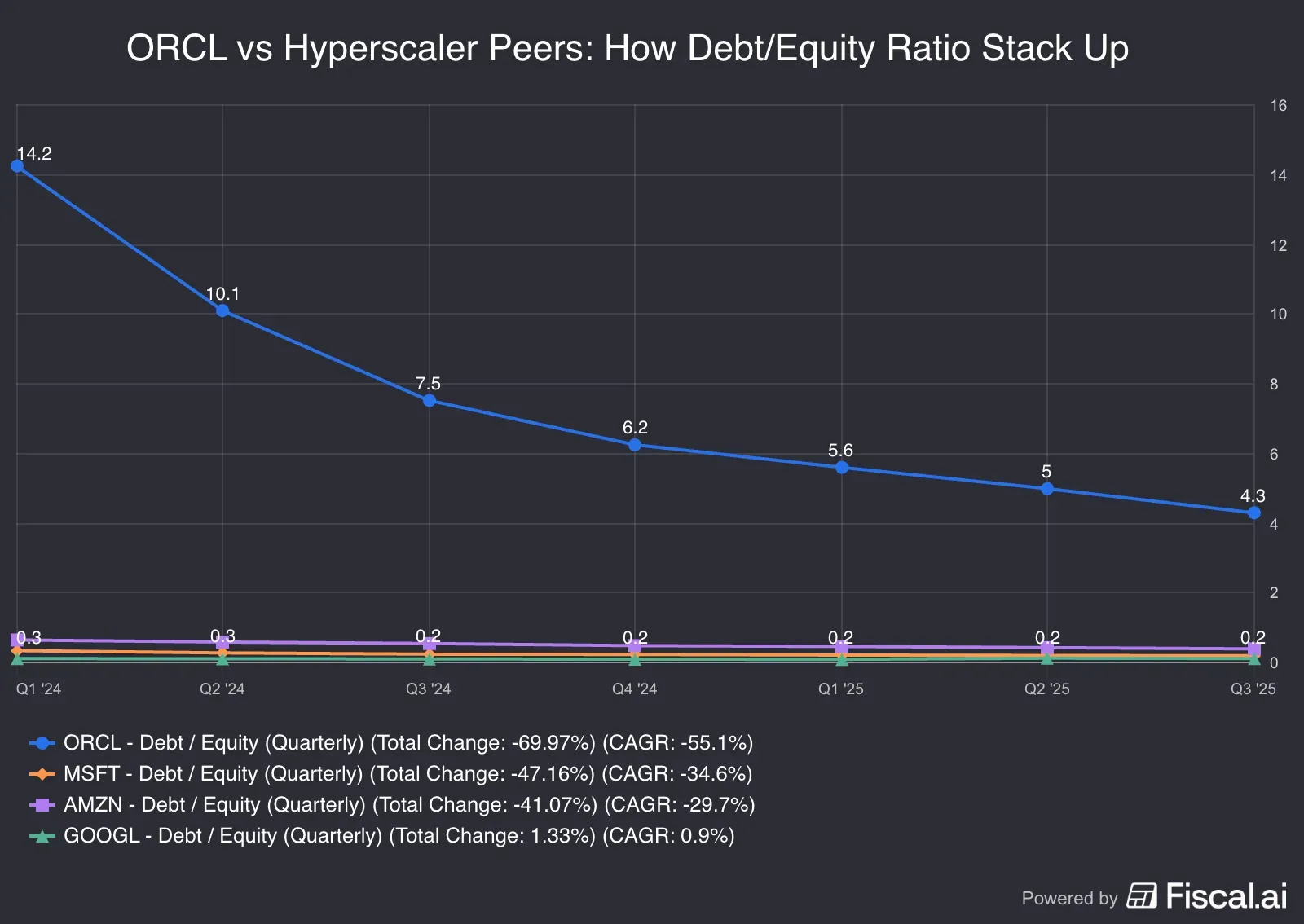

A comparison with hyperscaler peers underscores Oracle’s precarious financial health.

Source: Fiscal.ai<

Following the quarterly results, Oracle credit default swaps (CDS) — the cost of protecting its debt against a potential default — rose about 0.05 percentage point to 124.6 basis points a year over five years, Bloomberg reported, citing ICE Data.

The metric rises as investor confidence in credit quality takes a beating, and the recent quotes suggest investors now require slightly more compensation to insure against default.

The move is all the more critical for AI plays, as Oracle’s credit derivatives are often considered a barometer of AI risk. Citing Barclays credit strategist Jigar Patel, the report said trading volume on Oracle’s CDS climbed to $9.2 billion over the 10 weeks ended Dec. 5 from $410 million a year ago.

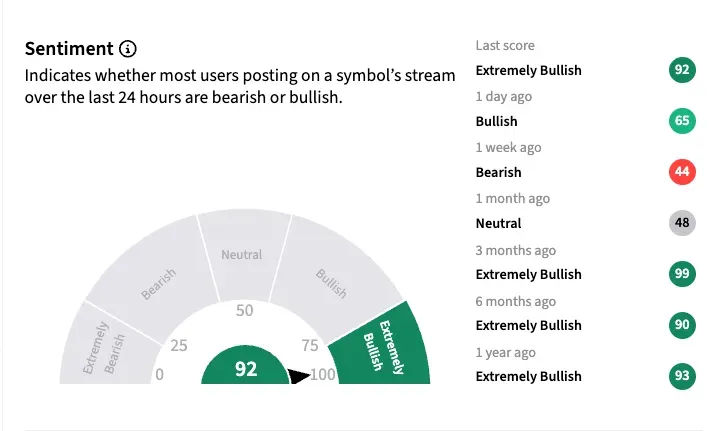

But Retail Backs ORCL Stock

Retail traders didn’t share Wall Street’s unease. Stocktwits sentiment for Oracle jumped into the ‘extremely bullish’ zone late Wednesday, up from ‘bullish’ a day earlier, reflecting confidence in the company’s long-term AI-cloud narrative. Retail sentiment toward the stock has remained firmly positive through most of the year.

According to Koyfin, the average 12-month analyst price target for the stock is $330.49, implying a nearly 50% discount. Of the 44 analysts covering the stock, 31 rate it as either a ‘Buy’ or ‘Strong Buy,’ 10 remain on the sidelines, and three have outright ‘Sell’ recommendations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<