- Bed Bath & Beyond stock closed 0.2% lower in the after-hours session following the retail company’s quarterly report.

- The company narrowed its adjusted loss, but revenue fell more than feared.

- Management is pushing the development of AI products to drive customer retention and workforce efficiency.

Bed Bath & Beyond Inc. released its quarterly results after Monday’s market close, triggering volatile trading in the stock, but retail sentiment improved.

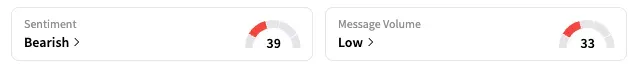

Shares gained as much as 13% in the early after-hours session before closing down 0.2%. On Stocktwits, the retail sentiment for BBBY shifted to ‘extremely bullish’ as of late Monday, from ‘neutral’ the previous day, with the ticker featuring among the top trending on the platform.

Improving Fundamentals

Bed Bath & Beyond narrowed its third-quarter loss, with the bottom line significantly better than Wall Street’s estimates, but revenue fell more than expected. The company expects revenue growth next year.

“The third quarter marked substantial progress towards achieving profitability through outstanding metric performance,” said Marcus Lemonis, executive chairman and principal executive officer. “As the Company prepares for 2026, we expect year-over-year revenue trends to turn positive.”

The home goods retailer, which owns its namesake brand as well as Overstock, buybuy BABY and a blockchain asset portfolio, said its revenue declined 17% to $257.2 million. Analysts expected $259.8 million.

The adjusted loss was $0.19 per share, compared to the analysts’ expectation of $0.31 per share loss.

AI Push

Lemonis said the company is pushing to grow its artificial intelligence (AI) tools and hinted that this could lead to greater workforce efficiency next year.

“Everybody should assume that AI is an absolute mandate inside of our company as it is in almost every company,” he said on the earnings call.

What Is Retail Investos’ View?

Retail traders’ comments on the Stocktwits platform were mixed; some expressed frustration with the lack of formal guidance, while others speculated on the potential for a meme-stock-style rally.

“$BBBY I root for turning around a company, but in my personal opinion, I don’t see how you could value this stock any more than 5$ in the short term,” said one user.

Another forecast an $8 price on Tuesday, adding that, “most of the AH (after-hours) must have been retail. If this get rough, could see mid $6. After that, who knows.”

Year-to-date, BBBY stock is up 74.4% as of the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<