The analyst’s sell calls come with targets of ₹222 for BHEL and ₹1,310 for Reliance in the near term.

SEBI-registered analyst Kush Ghodasara has flagged bearish calls in two stocks – BHEL and Reliance Industries (RIL), citing weak RSI trends and potential corrective moves.

Let’s take a look at the rationale behind his sell recommendations:

BHEL

The stock has witnessed a strong one-way rally this month, rising from lows of ₹209 to ₹242. Ghodasara noted some bearish momentum building around the stock price, which can be observed in its Relative Strength Index (RSI), which has turned lower.

He added that if BHEL stock closed below ₹242, it would breach the 5-day average on a closing basis for the first time since September 8. It could now test ₹229 at the support line. According to EW Theory, Ghodasara stated that there is a possibility of a fourth wave correction up to ₹222.

He recommended selling at the current market price (₹235), with a stop loss at ₹239.80 for target prices of ₹230 and ₹222.

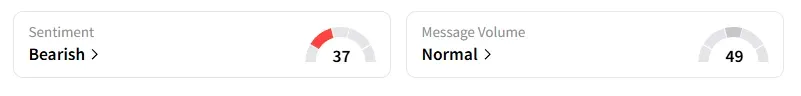

Data on Stocktwits also shows that retail sentiment has been ‘bearish’ for a week. BHEL shares have risen 3% year-to-date (YTD).

Reliance Industries (RIL)

The stock has been in a time-wise correction since the month of August but now it has been losing some momentum to bears. Ghodasara said that the weakness can be confirmed by a bearish crossover internally on the RSI and a downward trend.

RIL stock has been trading below the 5-15 day average combination for the last 2 days, and closing below ₹1,394 today will confirm a short-term negative bias. According to him, RIL may initiate a corrective wave C after completing a sideways move.

Ghodasara recommended selling Reliance stocks at current market price (near ₹1,386) with a stop loss at ₹1,410 for target prices of ₹1,364 and ₹1,310.

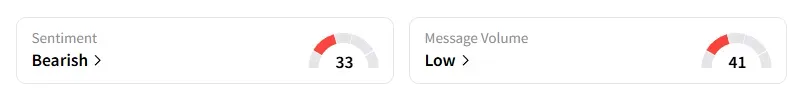

Data on Stocktwits also shows that retail sentiment has been ‘bearish’ for a week. BHEL shares have risen 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<