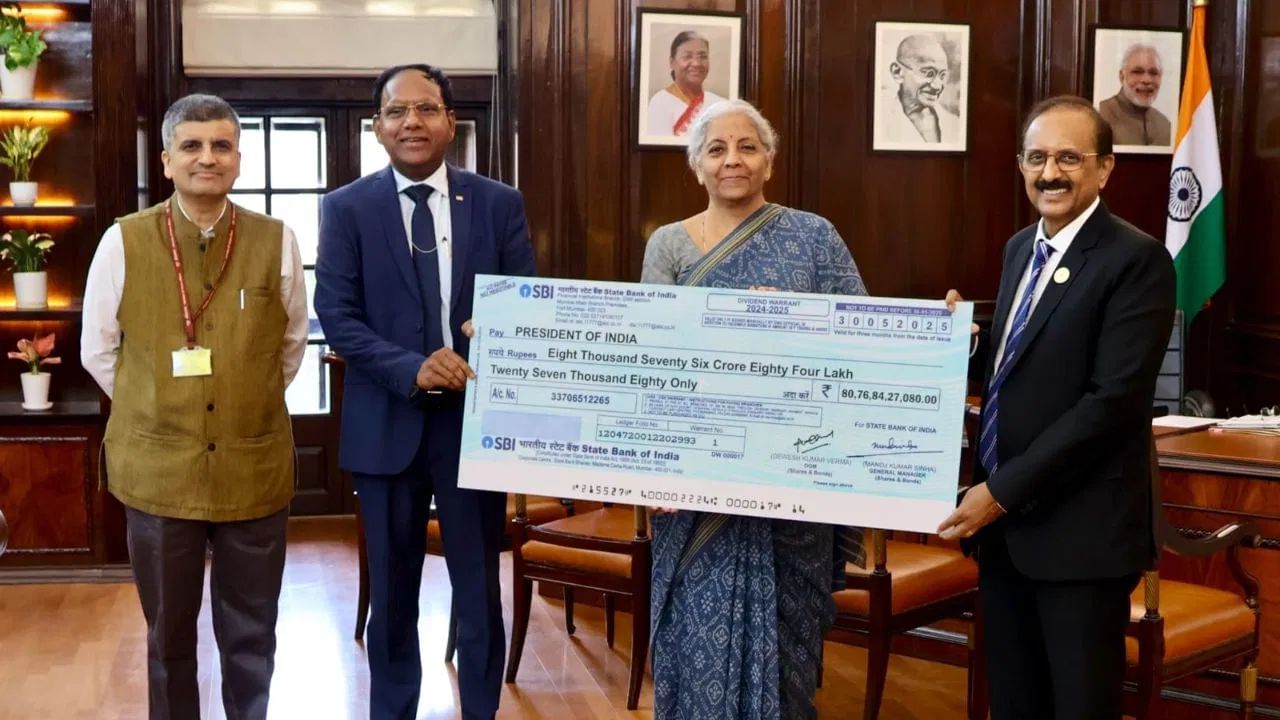

The public sector Indian Bank has submitted a dividend check of more than Rs 1,616 crore for the last financial year 2024-25 to the Central Government. Indian Bank said in a statement on Tuesday that the bank’s managing director and Chief Executive Officer (CEO) Binod Kumar handed over a dividend of Rs 1,616.14 crore to Finance Minister Nirmala Sitharaman for FY 2024-25. On this occasion, Secretary of Financial Services Department M Nagaraju and other officials were present.

According to the statement, the bank has declared a dividend of Rs 16.25 per share for FY 2024-25, which shows its dedication to create a long-term price for all parties including the Government of India with its strong financial performance. Let us tell you that before the Reserve Bank of India, State Bank of India, Canera Bank and Bank of Baroda have given about Rs 3 lakh crore to the government.

What happens to Hydividand?

When a company or bank earns profits, it gives some part of that profit to its shareholders as dividend. Since the government, these banks are very stakeholders, it also gets part of it. The dividend to the government from these banks increases its total revenue. This gives him more funds to spend in development plans, infrastructure projects and social welfare schemes.

Banks gave 3 lakh crore rupees

In FY 2025-26, the Reserve Bank of India (RBI) has transferred a dividend of Rs 2.69 lakh crore to the central government. This is much higher than last year (2.1 lakh crore rupees). State Bank of India (SBI), the country’s largest government bank, has given a dividend of Rs 8,076.84 crore to the government for FY 2024-25. Bank of Baroda has given a dividend of Rs 2,762 crore for FY 2024-25 (ended on 31 March). While Canara Bank has given a dividend of 2,283.41 crore to the government.