The company is pivoting to become a pure-play crypto services firm.

Bakkt Holdings stock (BKKT) has jumped over 144% this week, and remains on course for the biggest weekly gain since November last year.

The company, which is pivoting to become a pure-play crypto services firm, finalized the sale of its Loyalty business to Project Labrador Holdco, a subsidiary of Roman DBDR Technology Advisers, earlier this week.

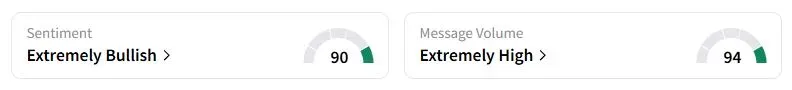

The stock gained 28.6% on Thursday, partly due to higher cryptocurrency prices. In extended trading, it was down 3.5%. Retail sentiment on Stocktwits about Bakkt was still in the ‘extremely bullish’ territory, while retail message volume was up nearly 150% over the past 24 hours.

Bakkt’s Loyalty business provided clients with travel and merchandise perks. At the time of the sale, the company stated that it had decided to divest the unit to concentrate exclusively on its cryptocurrency operations and evolve into a “pure-play” digital asset infrastructure platform.

In August, the company announced a share purchase agreement with RIZAP Group to acquire roughly 30% of the outstanding shares of MarushoHotta, a Tokyo-listed company. The move was intended to broaden Bakkt’s international exposure to Bitcoin holdings, according to the company’s filing with the Securities and Exchange Commission (SEC).

According to TheFly, earlier this week, Clear Street analysts noted that Bakkt’s stablecoin infrastructure is gaining attention due to its well-positioned status in the high-growth cross-border payment segment. The brokerage also noted the stock warrants a higher multiple, in line with stablecoin peers.

“This company is not what you shorts did in the past 3 years. Times have changed! You better accept it’s over,” one Stocktwits user said. The stock had a high short interest of 17.7%, according to Koyfin data.

“Just because it needs to cool off after quite the run doesn’t mean it’s over. Too many stupid shorts trying to spread fear when they are the ones that are losing now,” another user said.

Bakkt stock has gained nearly 74% this year, compared with 9.8% gains of the Financial Select Sector SPDR Fund.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<