The company expects full-year gold production of 820,000 to 970,000 ounces.

- B2Gold’s Q4 adjusted EPS of $0.11 missed the $0.18 consensus.

- The company’s Q4 gold production of 303,029 ounces beat expectations across major mines.

- BTG declared a first-quarter 2026 dividend of $0.02 per share, payable on March 19.

B2Gold Corp. (BTG) shares tumbled about 10% in extended trading on Wednesday after a fourth-quarter (Q4) earnings miss overshadowed the miner’s record annual revenue and strong operating performance.

BTG stock rose over 2% in Wednesday’s regular trading session.

Earnings Miss Overshadows Record Revenue

B2Gold reported adjusted earnings of $0.11 per share in Q4, below the $0.18 consensus estimate. Meanwhile, Q4 gold revenue rose to $1.05 billion, more than double the level a year earlier.

For the full year, the company posted record revenue of $3.06 billion in 2025 on gold sales of 927,797 ounces at an average realized price of $3,299 per ounce.

Total consolidated gold production for the quarter was 303,029 ounces. Fekola, Masbate and Otjikoto all surpassed forecasts. Commercial production was achieved at Goose Mine on Oct. 2, 2025, and production for the quarter was 38,616 ounces.

Annual gold production totaled 979,604 ounces, which includes 14,554 ounces of pre-commercial production at Goose. Though below the middle of the company’s guidance range of 940,000 to 1,045,000 ounces, production at the three core mines hit the midpoint of each individual guidance range.

B2Gold expects full-year gold production of 820,000 to 970,000 ounces.

Strong Output Lowers Unit Costs in Q4

B2Gold said consolidated cash operating costs were $736 per ounce in Q4, lower than expected due to higher production. However, all-in sustaining costs rose to $1,754 per ounce sold, driven by the timing of shipments at Fekola and higher royalties tied to stronger gold prices.

On a full-year basis, cash operating costs averaged $769 per ounce, below the low end of guidance, while all-in sustaining costs averaged $1,584 per ounce sold, near the bottom of the projected range.

Cash Flow Remains Strong

Operating cash flow before working capital adjustments totaled $211 million in Q4 and $940 million for the full year. At the end of the year, B2Gold held $380 million in cash and cash equivalents and had $750 million available under its revolving credit facility.

The company also repurchased 7 million shares for $34 million under its normal course issuer bid and declared a first-quarter 2026 dividend of $0.02 per share, payable on March 19.

How Did Stocktwits Users React?

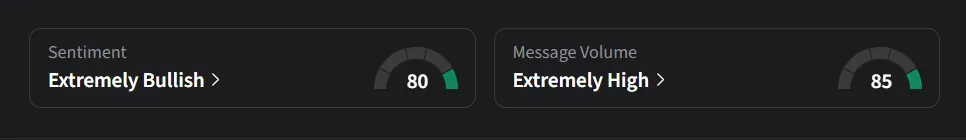

On Stocktwits, retail sentiment for BTG was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “This is still super cheap compared to other stocks with a 46 cents of earnings the last 4 quarters this is cheap at least.”

Another user said, “dead money for 6 months. Then expect a big rerate. H2 is going to be very strong. The only thing that can derail this is a drop in gold price.”

BTG stock has risen 19% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<