The analyst highlights ₹900–₹910 as a critical support band to watch.

Tata Chemicals has been in a persistent downtrend for almost two months, currently trading near ₹900. Over the past month, the stock has declined 7%. And analysts believe that caution is warranted until a clear reversal emerges.

SEBI-registered analyst Deepak Pal said Tata Chemicals traded below all the key moving averages (20, 50, 100, 200-day), reflecting continued weakness in both short-term and long-term momentum.

Other technical indicators, such as the Parabolic SAR, also showed a strong sign of selling pressure. The Relative Strength Index (RSI) stood around 34, suggesting the stock is in the oversold zone and showing initial signs of a possible reversal, yet no solid confirmation is visible.

Pal flagged that the ₹900-910 support band is a highly significant psychological and historical zone, but despite previous buying interest at this level, no robust reversal signal has formed yet. Without confirmation, downside risk persists.

Fundamental View

The stock is expensive with a P/E above 40 and P/B around 1.24-1.26. He added that weak earnings shows over the last few quarters, muted management commentary, and the announcement of TataChem’s exit from the F&O segment have further weakened sentiment. And the formation of lower highs and lower lows has reinforced the bearish structure.

But positives such as manageable debt, a 94% dividend payout, and long-term growth driven by specialty chemicals, global expansion, sustainability focus, and investments in advanced materials and green chemistry augur well for Tata Chemicals, according to Pal.

At ₹900, is this a buy?

In the short term, Pal believes that the setup is still weak, and no clear reversal candle is present. He advised traders to avoid buying until reversal signals or volume spikes are observed. Any pullback may encounter resistance at ₹950–₹975, while a close below ₹900 could indicate further downside toward ₹865–₹850.

For long-term investors, he recommended gradual, phased accumulation below ₹900. However, Pal cautioned that investors must wait for proper bottoming signals before large allocation. Staggered small-lot buying is a safer approach.

Triggers to watch

Tata Chemicals will exit the F&O segment in October 2025, adding to near-term price pressure. Investors will also be monitoring Q2 results (expected end-October or November).

What Is The Retail Mood?

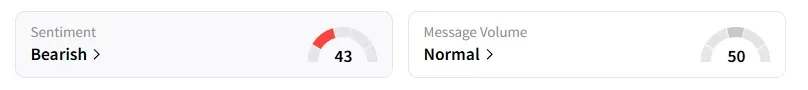

Data on Stocktwits showed that retail sentiment moved from ‘neutral’ last month to ‘bearish’ last week.

Tata Chemicals shares have declined 14% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<