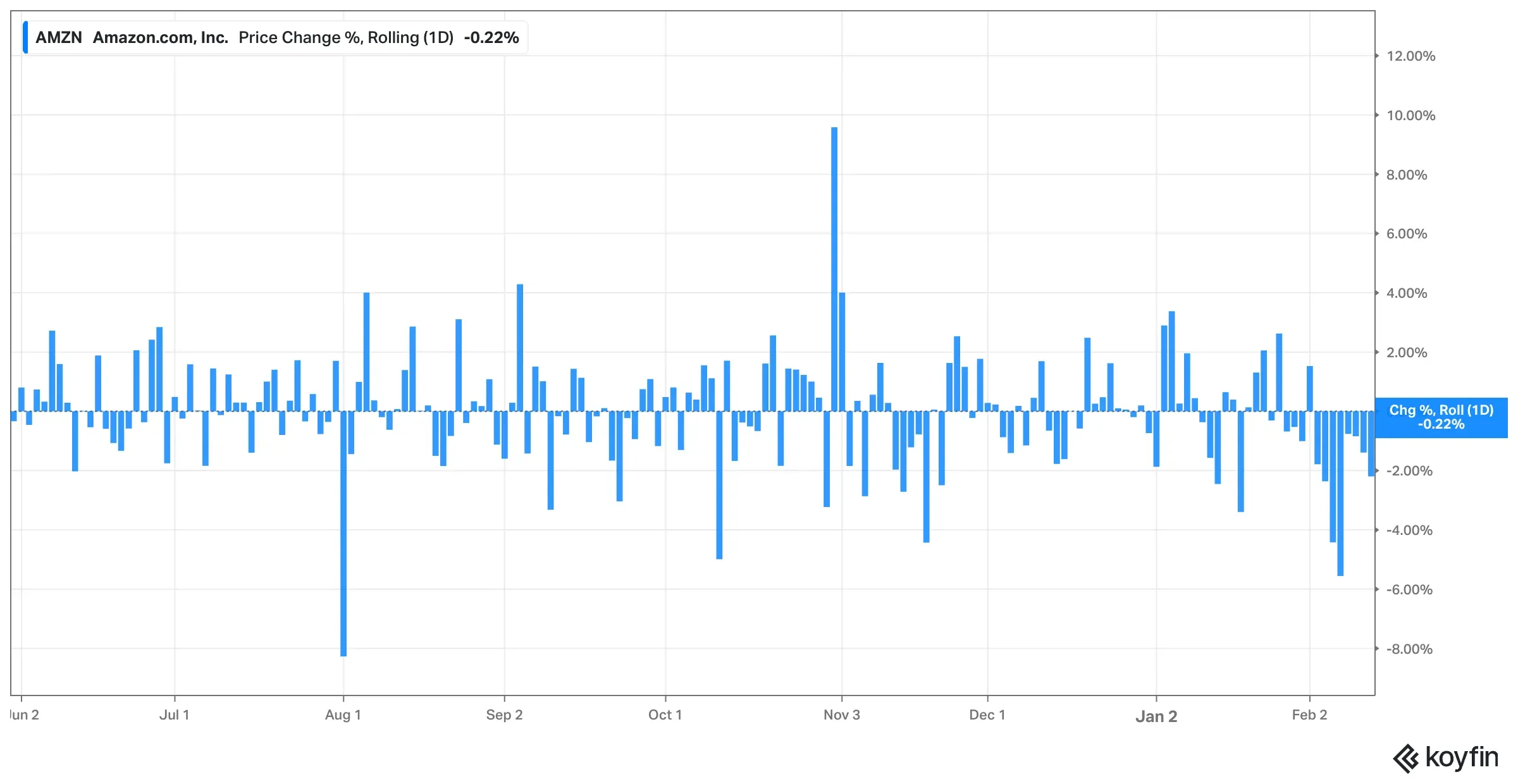

Amazon.com stock has lost about 17.5% of its value in the last one month, even as the company’s shares hover near their lowest level since May 23, 2025.

- One bullish user on Stocktwits said they have not seen Amazon shares being this cheap on a price-to-earnings ratio in at least the last decade.

- In its latest earnings results, Amazon said it would boost its capital expenditure for 2026 to $200 billion, up from about $130 billion reported in 2025.

Amazon.com (AMZN) shares are poised for a ninth straight day of losses as concerns over the tech giant’s sharply higher capital spend planned for 2026 rise among investors.

AMZN shares reversed to green, climbing 0.27% higher on Friday at the time of writing, after having declined about 0.7% earlier in the day.

The stock has lost about 17.5% of its value in the last month, even as the company’s shares hover near their lowest level since May 23, 2025, when they opened at $198.90.

On Stocktwits, retail sentiment around the stock has fallen in the past 24 hours, dropping from the ‘extremely bullish’ to ‘bullish’ territory at the time of writing. Meanwhile, retail chatter has jumped about 35% in the same period, according to Stocktwits data from Friday morning.

What Are Stocktwits Users Saying?

One user on Stocktwits said that AMZN shares would trade higher after the soft January inflation report. The user said that lower rates were on the horizon on an ‘already completely over sold stock.’

Another bullish user said they have not seen Amazon shares being this cheap on a price-to-earnings ratio in at least the last decade.

However, one user warned of more declines, including another dip next week, adding that the company would likely not breach $240 for another three to four months.

Another bullish user said that now would be the best time to buy a mega cap stock amid pullbacks, forecasting that AMZN shares would soar past $300 in the next six to 12 months.

Capital Spend

In its latest earnings results, Amazon said it would boost its capital expenditure for 2026 to $200 billion, up from about $130 billion reported in 2025.

This is in line with other large tech companies that have collectively announced plans to invest over $630 billion in AI buildouts in 2026, more than double the spend from 2025.

Andy Jassy, President and CEO of Amazon, told investors that the capital expenditures would predominantly be in Amazon Web Services because of “very high demand,” adding that the company anticipated “strong long-term return on invested capital.”

While investors have largely expressed concerns over the massive expenditures on AI by the tech companies, leaders have actively backed the plan. CEO of Nvidia Corp. (NVDA) Jensen Huang said earlier this month that these investments are “appropriate and sustainable,” noting that the demand for AI is now skyrocketing.

Meanwhile, shares of AMZN have declined by over 13% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<