The announcement followed a strong third quarter, with total revenue up 12% year-over-year, led by a 92% jump in Ibsrela sales and steady Xphozah growth.

- The company filed a new shelf registration with the SEC that allows sales of up to $100 million in stock, debt, or other securities through Jefferies LLC.

- The announcement followed a strong third quarter, with total revenue up 12% year-over-year, led by a 92% jump in Ibsrela sales and steady Xphozah growth.

- Retail traders on Stocktwits largely dismissed dilution concerns, calling the move a routine step to maintain financial flexibility for future growth.

Ardelyx shares slipped nearly 6% in after-hours trading on Monday after the company said it may sell up to $100 million in stock through Jefferies, just days after delivering its strongest quarter of the year that sent the shares surging to their biggest one-day gain since May 2024.

Potential Capital Raise

The company also filed a shelf registration statement with the U.S. Securities and Exchange Commission that will allow it to sell stock, debt, or other securities periodically as a “well-known seasoned issuer.”

Jefferies signed a new agreement with Ardelyx that allows the biotech to sell up to $100 million of its common stock through an at-the-market offering. The bank would receive a commission of up to 3% of the proceeds.

The filing gives Ardelyx room to raise cash for operations and pipeline work. However, the announcement sparked concerns about share dilution.

Earnings Review

Last week, Ardelyx reported third-quarter revenue of $110.3 million, up 12% from a year earlier, powered by Ibsrela’s 92% jump in sales to $78.2 million and steady 9% growth in Xphozah revenue to $27.4 million.

Margins continued to improve, with gross-to-net deductions holding steady at around 31% for Ibsrela and 29% for Xphozah.

The company’s net loss narrowed sharply to about $1 million, compared with $19.1 million in the previous quarter, as sales rose and costs were kept in check.

Research expenses rose to $18.1 million with the addition of new programs, while SG&A was essentially flat at $83.6 million. The company had cash and short-term investments of $242.7 million at the end of September.

Product Outlook

Following the strong report, Ardelyx raised its full-year forecast for Ibsrela revenue to $270-$275 million, reflecting sustained demand and a growing base of prescribers.

It also reaffirmed a long-term peak sales target of $750 million for Xphozah, despite reimbursement challenges under Medicare’s Transitional Drug Add-on Payment Adjustment (TDAPA) program.

The company expects Xphozah’s gross-to-net deductions to remain near 29% through the fourth quarter, and said patient access and prescription fulfillment are improving through its ArdelyxAssist support program.

Stocktwits Traders Dismiss Shelf Filing Concerns

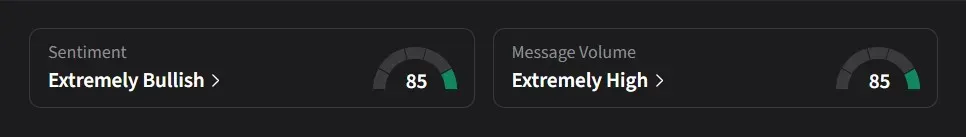

On Stocktwits, retail sentiment for Adelyx was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the filing was a standard precaution to ensure flexibility and support future growth, adding that CEO Michael Raab had consistently delivered results and could drive the company toward an eventual buyout.

Another user noted that the new $100 million shelf replaces a 2023 program that still had unused capacity and called it a routine housekeeping move rather than a sign of financial stress.

Adelyx’s stock has risen 17% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<