On Tuesday, Lucid Capital initiated coverage of Applied Digital with a “Buy” rating, citing the company’s strong position to capitalize on the growing demand for large-scale computing power.

Applied Digital Corp. (APLD) stock hit fresh 21-year highs, breaking the $40 level on Wednesday, due to continued spotlight on its artificial intelligence infrastructure projects.

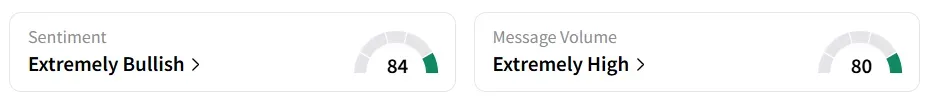

At the time of writing, the stock pared some of the gains and traded over 7% higher. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 300% surge in user message count over the last month. A bullish Stocktwits user highlighted the importance of infrastructure in the AI boom.

On Tuesday, Applied Digital received a bullish outlook from Lucid Capital, as the firm began coverage of the company with a “Buy” rating and a price target of $44. The firm said the company is well-positioned to benefit from the rising demand for large-scale computing power.

Lucid analyst Joe Flynn said the company, along with other high-performance compute (HPC) firms, is “positioned to capitalize on power shortages and other related constraints,” as demand for energy-intensive computing grows.

In its first-quarter earnings call on October 9, Applied Digital Chairman and CEO Wesley Cummins said the company is actively building its second major data campus, Polaris Forge 2, and anticipates significant expansion driven by increasing power availability and demand from hyperscale clients.

With a $3 billion investment, Polaris Forge 2 will deliver 200 MW of critical IT load initially, with room to grow.

Applied Digital stock has gained over 391% year-to-date and over 413% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<