JPMorgan now estimates that Apple will ship approximately 236 million iPhones in fiscal year 2026, representing a 2% year-over-year increase.

JPMorgan has increased its 12‑month price target for Apple Inc. (AAPL) to $280 from $255, while continuing to assign an “Overweight” rating on the stock. The firm cited early strong demand for the iPhone 17 and a promising outlook for future products as reasons for its upgraded forecast.

JPMorgan pointed to robust initial demand for the iPhone 17 series as a key driver of better revenue expectations, according to TheFly. It also factored in growth from a foldable iPhone planned for fall 2026, which is expected to boost both unit sales and profitability in Apple’s fiscal 2027.

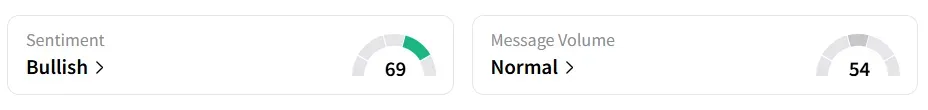

Apple stock traded over 3% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

JPMorgan now estimates that Apple will ship approximately 236 million iPhones in fiscal year 2026, representing a 2% year-over-year increase. With this volume, the firm projects mid- to high-single-digit growth in iPhone revenue for 2026.

For the first time since 2020, Apple has rolled out multiple new iPhone designs, including the iPhone 17 Pro, Pro Max, and the iPhone Air, alongside an Apple Watch lineup featuring the Watch SE, Series 11, Ultra 3, and new AirPods Pro 3.

According to a Bloomberg report, early sales across Asia showed strong demand for the Pro models. As iPhone 17 sales went live in New York, Cook said in an interview with CNBC that Apple Watch’s growth prospects in health monitoring looked bright with the rollout of the hypertension notification feature.

Apple stock has lost 2% in 2025 and has gained over 7% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<