The firm said it would invest $6.5 billion for a 50% stake in Ørsted’s Hornsea 3, the world’s largest offshore wind project.

- APO stock gained 3.5% to $128.3 in premarket trade

- APO’s profit surged 20% in Q3, driven by robust asset growth and performance fees.

- Assets under management (AUM) rose to $908 billion, moving closer to 2026 target.

Shares of Apollo Global Management (APO) climbed 3.5% to $128.3 in premarket trade on Tuesday, after the company posted better-than-expected third-quarter results. The company also invested $6.5 billion in the world’s largest offshore wind farm project.

Apollo Global reported a 20% jump in profit in Q3, driven by asset growth, higher performance fees, and debt origination. Adjusted net income rose to $1.36 billion, or $2.17 per share, exceeding street estimates of $1.22 billion, or $1.91 per share.

Quarterly inflows of $82 billion lifted assets under management to $908 billion, moving the firm closer to CEO Marc Rowan’s target of $1 trillion by 2026.

Retirement Services Remains A Growth Engine

Apollo’s retirement services unit, Athene, continued to perform strongly, with spread-related earnings climbing to $871 million and fee-related earnings reaching a record $652 million. About $34 billion of new capital came from acquiring Bridge Investment Group, while $10 billion flowed into Athene’s retail operations.

$6.5 Billion Bet On Offshore Wind

On Monday, Apollo announced that funds managed by the firm will invest $6.5 billion for a 50% stake in Ørsted’s Hornsea 3, the world’s largest offshore wind project. Located in the North Sea, Hornsea 3 will have a total capacity of 2.9 gigawatts (GW) once completed, generating renewable power for over 3 million UK households.

Under the agreement, Ørsted will continue to handle construction through a full-scope EPC contract, as well as long-term operations, maintenance, and power market management. The transaction is expected to close by the end of 2025. Apollo Funds will contribute roughly $3.25 billion at closing, with the balance invested as project milestones are achieved.

The deal’s senior financing is being led by Apollo-managed entities, with BNP Paribas, ING, Lloyds, and RBC Capital Markets underwriting the bank facilities.

This follows Apollo’s recent energy infrastructure investments, including €3.2 billion for Germany’s energy grid expansion and £4.5 billion in financing for EDF’s Hinkley Point C nuclear project.

What Are Retail Investors Saying?

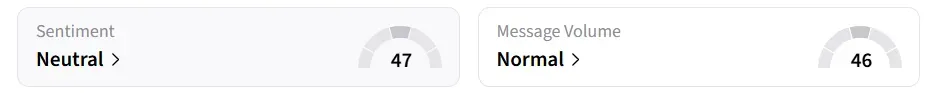

Despite the premarket uptick, retail sentiment on Stocktwits shifted to ‘neutral’ from ‘bearish’ a session earlier.

The firm’s shares have declined by more than 25% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<