B. Riley raised the target on Applied Digital to $53 from $47 while maintaining a ‘Buy’ rating.

- Applied Digital is poised to sign incremental hyperscaler agreements at new sites, the analyst said in a note.

- B. Riley also highlighted the company’s simultaneous execution of two initial energization deals.

- Earlier, Roth Capital increased the price target on Applied Digital to $58 from $56 with a ‘Buy’ rating, citing stronger-than-expected momentum after its latest quarterly results that beat consensus estimates.

Applied Digital Corp. (APLD) shares garnered attention on Friday after B. Riley raised its price target on the firm, citing optimism on hyperscaler agreements and energization executions.

The analyst raised the price target on Applied Digital to $53 from $47 while maintaining a ‘Buy’ rating on its shares, as per TheFly.

Applied Digital is poised to sign incremental hyperscaler agreements at new sites, the analyst said in a note, adding that the company is simultaneously executing on the initial energization at PF1 and development at PF2.

Shares of APLD rose over 15% on Friday at the time of writing.

Street Consensus

Earlier, Roth Capital increased the price target on data center developer and operator to $58 from $56 with a ‘Buy’ rating, noting its stronger-than-expected momentum after its latest quarterly results.

As per Roth, Applied Digital’s financials did not primarily drive the upgrade, but rather, the firm’s growing customer interest and large-scale discussions could potentially increase the company’s operating footprint.

Meanwhile, Arete, and Freedom Capital both initiated coverage on the company this month, giving the stock a ‘Buy’ rating.

Stellar Earnings

In the second quarter (Q2), Applied Digital clocked a revenue of $126.6 million, a 250% jump year-on-year, while reporting zero adjusted earnings per share (EPS). The company’s revenue and EPS beat analysts’ estimates of $81.2 million and a loss of $0.12 per share, respectively as per Fiscal.ai data.

The earnings update also brought into limelight the company’s increased contribution as a provider of specialized data center capacity.

The company said that it signed two new leases with hyperscalers across two campuses in North Dakota. CoreWeave’s 400 MW under contract at Polaris Forge 1 would bring in about $11 billion of prospective lease revenue over the term of its leases, while an unnamed investment-grade American hyperscaler holds 200 MW at Polaris Forge 2, expected to contribute about $5 billion of prospective lease revenue over the term of its lease, the company said.

How Did Stocktwits Users React?

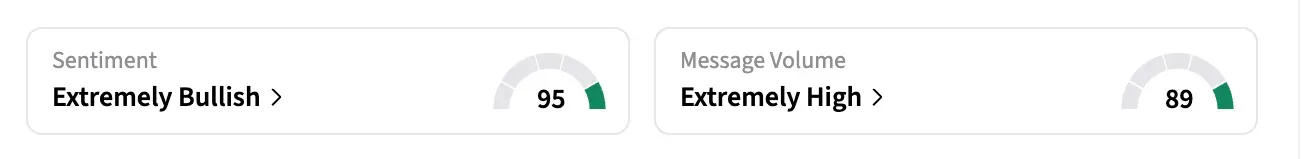

On Stocktwits, retail sentiment around APLD shares trended in the ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volume.

APLD stock has rallied over 343% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: Why Did LRHC Stock Surge Over 40% Today?