In a post on the X platform, Citron Research said that Amentum is positioned to manage almost 90% of America’s Department of Energy (DOE) nuclear operations.

- Citron claimed Amentum has over 40 years of experience and holds all necessary security clearances.

- According to Citron, Amentum trades at a relatively modest valuation.

- AMTM stock traded over 9%higher following Citron Research’s analysis.

Amentum Corp. (AMTM) has drawn fresh attention after Citron Research made bullish claims that the company controls a vast portion of the United States’ nuclear infrastructure and stands to benefit from the President Donald Trump-led nuclear buildout.

In a post on the X platform, Citron Research said that Amentum is positioned to manage almost 90% of America’s Department of Energy (DOE) nuclear operations.

Strategic Nuclear Bet

According to Citron, Amentum isn’t just another contractor. The firm claimed Amentum has over 40 years of experience, holds all necessary security clearances, and has a workforce versed in legacy nuclear operations, making it irreplaceable in the industry.

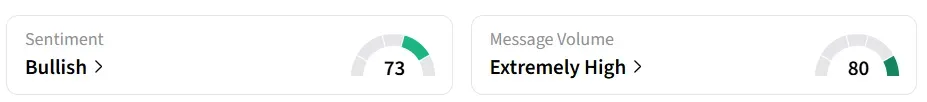

Amentum’s stock traded over 9% higher on Wednesday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘extremely high’ message volume levels.

Both retail sentiment and message volume were at their highest year-to-date levels.

Despite its monopoly-like positioning in nuclear infrastructure, Citron stated that Amentum trades at a relatively modest valuation. The company is scheduled to report its fourth-quarter earnings on November 25. Analysts expect a revenue of $3.6 billion and earnings per share (EPS) of $0.59, according to Fiscal AI data.

Policy Tailwinds

Citron highlighted recent moves from the Trump administration that could boost Amentum’s growth: a $1 billion loan to restart the Three Mile Island plant, an executive order targeting 400 GW of nuclear capacity by 2050, and a $250 billion DOE lending program focused on nuclear development.

The firm cited that accelerated nuclear development is deeply linked with AI’s future. Citron suggested AI data centers will demand stable, large-scale electricity, and Amentum is capable of powering that shift.

AMTM stock has gained over 14% in 2025 and over 9% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<