AMD’s strong results did not serve to offset investors’ negative sentiment toward the stock, with some viewing soft margin guidance as the sore spot.

- Lisa Su said record revenue and profitability reflected broad-based demand for its high-performance EPYC and Ryzen processors and Instinct AI accelerators.

- Client revenue clocked another record due to its 46% YoY growth.

- Cloud customer Amazon sold all of the 822,234 AMD shares it held at the end of the second quarter.

Advanced Micro Devices, Inc. (AMD) stock fell nearly 4% in Tuesday’s extended session despite the chipmaker reporting strong quarterly results, but retail sentiment flipped to positive. Separately, Amazon, which uses AMD chips to power its cloud, disclosed in a filing that it has sold its stake in AMD.

AMD’s after-hours drop came after it fell 3.70% in the regular session amid the broader market sell-off. The major index futures plunged overnight, indicating another session of selling on Wednesday.

AMD’s Q3 Earnings Snapshot

Santa Clara, California-based AMD’s revenue for the third quarter of the fiscal year 2025 rose 36% year over year (YoY) and 20% sequentially, thanks primarily to strong Client and Gaming segment revenue.

CEO Lisa Su said, “We delivered an outstanding quarter, with record revenue and profitability reflecting broad-based demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators.”

Here’s how the headline number panned out:

-Adjusted earnings per share (EPS): $1.20 (up 30% YoY) vs. $1.17 consensus (Fiscal.ai)

-Revenue: $9.25 $9.25B vs. $8.75B consensus

-Adj. gross margin: 54%

Data center revenue rose 22% YoY to $4.3 billion, driven by strong demand for the company’s 5th-generation EPYC server processors and its MI350 artificial intelligence (AI) chip. Client and Gaming revenue jumped 73% to $4 billion, with client revenue setting another record at 46% YoY growth and Gaming sales soaring 181%.

AMD’s Q4 Outlook

For the fourth quarter, AMD forecast revenue of approximately $9.6 billion, plus or minus $300 million, compared to the $9.20 billion consensus. The company also clarified that the revenue outlook did not include any revenue from its China-specific MI308 AI chip shipments. The company also guided gross margin to be about 54.5%. A CNBC report said the after-hours stock drop may have been due to soft gross margin guidance.

Su said, “Our record third quarter performance and strong fourth quarter guidance marks a clear step up in our growth trajectory as our expanding compute franchise and rapidly scaling data center AI business drive significant revenue and earnings growth.”

Amazon Cashes Out

A 13F filing by Amazon showed that the e-commerce giant sold all of the 822,234 AMD shares it held at the end of the second quarter.

What Retail Feels About AMD Stock After Q3 Results

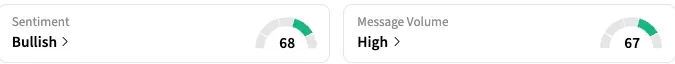

On Stocktwits, retail sentiment toward AMD stock shifted to ‘bearish’ by late Tuesday, following the bearish mood observed a day prior. The message volume also increased to ‘high’ levels.

Calling the earnings “great,” a bullish user predicted the stock would hit $300 by year-end.

Another user expected analysts to upgrade AMD stock on Wednesday.

AMD stock has gained approximately 107% this year, receiving a significant boost in early October when it struck a multi-billion-dollar, multi-year deal with OpenAI to deploy 6 gigawatts (GW) of AMD GPUs.

In a note previewing the results, Morgan Stanley analyst Joseph Moore did not sound optimistic about the near term. The focus will be on next year’s rack-scale MI450, Moore said. “Given the rally, we need very strong outcomes from MI450 to be bullish from here, which remains a show-me situation.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.<