With investor sentiment running high and Microsoft’s market value topping $4 trillion, the spotlight is on whether the “Magnificent Seven” members can keep the AI rally alive.

- The Roundhill Magnificent Seven ETF (MAGS), which tracks seven mega-cap stocks, has gained nearly 26% this year.

- Alphabet, Microsoft and Meta are expected to report YoY EPS and revenue growth.

- Retail sentiment toward Meta remains sour despite the company being positioned to report the fastest revenue growth among the three.

The first of the megacap tech earnings will begin to roll in on Wednesday amid optimism over artificial intelligence (AI)-powered quarterly outperformance. Nvidia (NVDA) CEO Jensen Huang’s Washington GTC keynote cemented hopes of good tidings from these names, which are part of an elite group known as the “Magnificent Seven.”

Microsoft is scheduled to report its fiscal-year 2026 first-quarter results, while Alphabet and Meta will announce their third-quarter results for the fiscal year 2025.

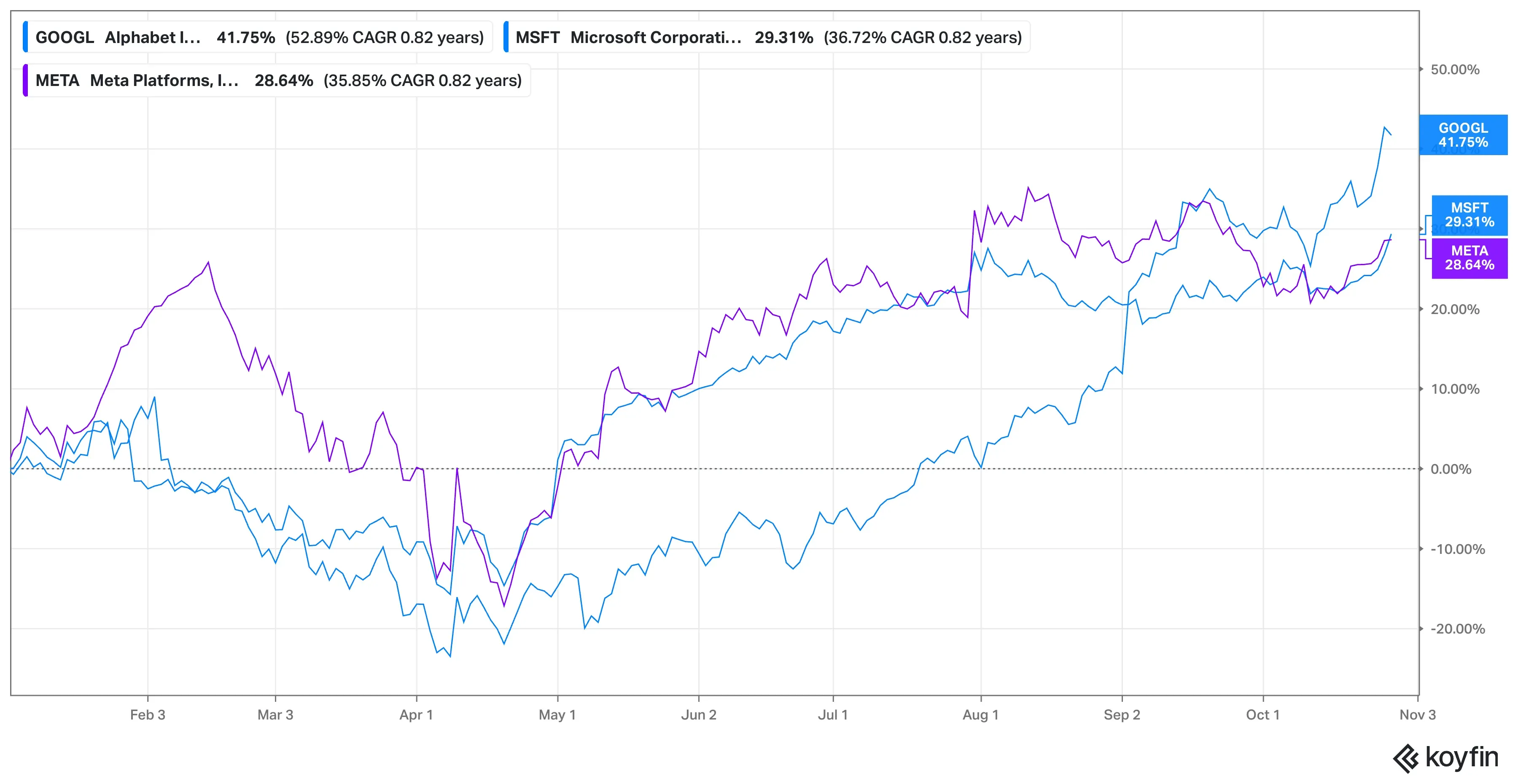

Stock Performances: GOOGL Vs. MSFT Vs. META

The Roundhill Magnificent Seven ETF (MAGS), an exchange-traded fund (ETF) tracking the performance of these stocks, has gained nearly 26% this year. Among the trio reporting on Wednesday, Alphabet’s stock has been the outperformer, having gained almost 42% year to date (YTD). Meta and Microsoft shares have gained about 29% each.

Chart courtesy of Koyfin<

Chart courtesy of Koyfin<

Analysts’ Expectations: GOOGL Vs. MSFT Vs. META

All three companies are expected to report year-over-year (YoY) earnings per share (EPS) and revenue growth, with Meta’s revenue likely to grow the fastest. Here’s how the consensus (Fiscal.ai-compiled) estimates stack up versus the year-ago numbers:

Alphabet:

– EPS: $2.27 ($2.12)

– Revenue: $100.14B ($88.27B)

Microsoft:

– EPS: $3.66 ($3.30)

– Revenue: $75.34B ($65.58B)

Meta:

– EPS: $6.65 ($6.03)

– Revenue: $49.34B ($40.59B)

Investors Focus: GOOGL Vs. MSFT Vs. META

Capex spending plans of the three names could be of interest to investors, as these companies splurge on building data center clusters to power AI applications and processes.

Given that Microsoft’s Azure private cloud computing platform and Alphabet’s Google Cloud Platform (GCP) are ranked number two and three among cloud service providers, the spotlight will likely be on the pace of growth or a lack thereof for the segment.

Ad revenue growth could be key for Alphabet’s Google and Meta, with the latter deriving more than 97% of its revenue from advertising. Traders may also focus on contributions from Meta’s Reality Labs business, which develops virtual reality (VR) and augmented reality (AR) hardware and software.

How Retail’s Positioned Ahead Of Earnings

An ongoing Stocktwits poll, powered by Polymarket, found that 80% of respondents (about 12,000) expected Google to beat earnings estimates. A separate poll on Meta’s earnings expectations showed that 73% of the 12,300 respondents who have chimed in so far factored in a beat.

Retail sentiment, message volume as of early Wednesday Vs. a day ago:

Alphabet:

-Bullish Vs. Extremely Bullish

-High Vs. Extremely High

Microsoft:

-Extremely Bullish Vs. Bullish

-Extremely High Vs. High

Meta

-Bearish (unchanged)

-Normal (unchanged)

In Wednesday’s early premarket session, Alphabet stock rose 0.66%, Microsoft added 0.35%, and Meta gained 0.47%. Thanks to a nearly 2% rally in Microsoft stock on Tuesday, the software giant’s market capitalization went past the coveted $4 trillion mark. Two of the remaining Mag Seven companies, Apple (AAPL) and Amazon (AMZN), are due to announce their quarterly results on Thursday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<