Analysts are taking notice of Bitcoin after Ethereum’s accumulation patterns where Tom Lee noted that Ethereum has repeatedly recovered in a V-shape after significant declines.

- Glassnode data showed that whales have taken out an estimated 60,000 to 100,000 BTC from exchanges.

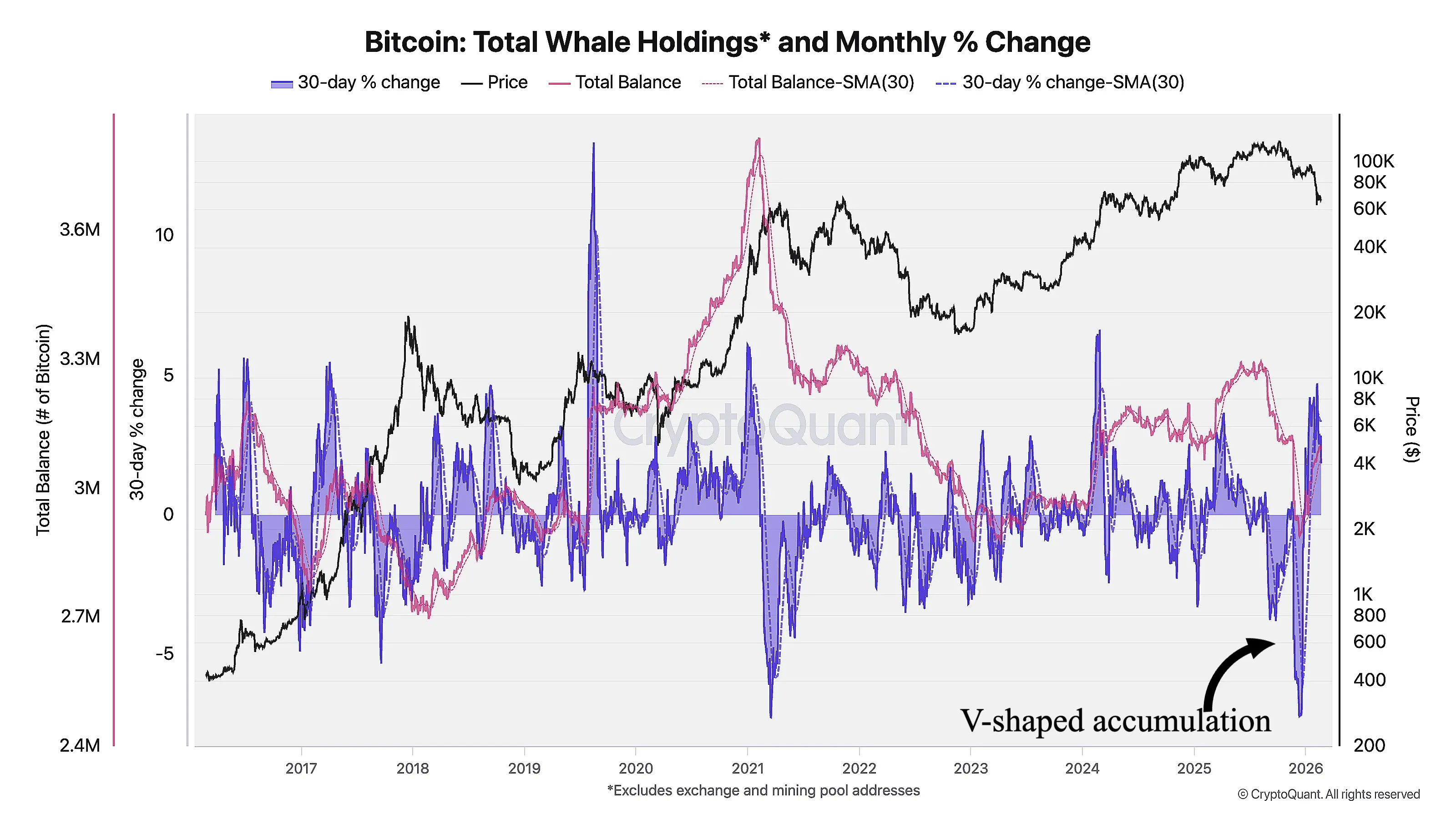

- Analyst Cauconomy said the entire post-October whale drawdown has now been reversed, indicating prices might uptick.

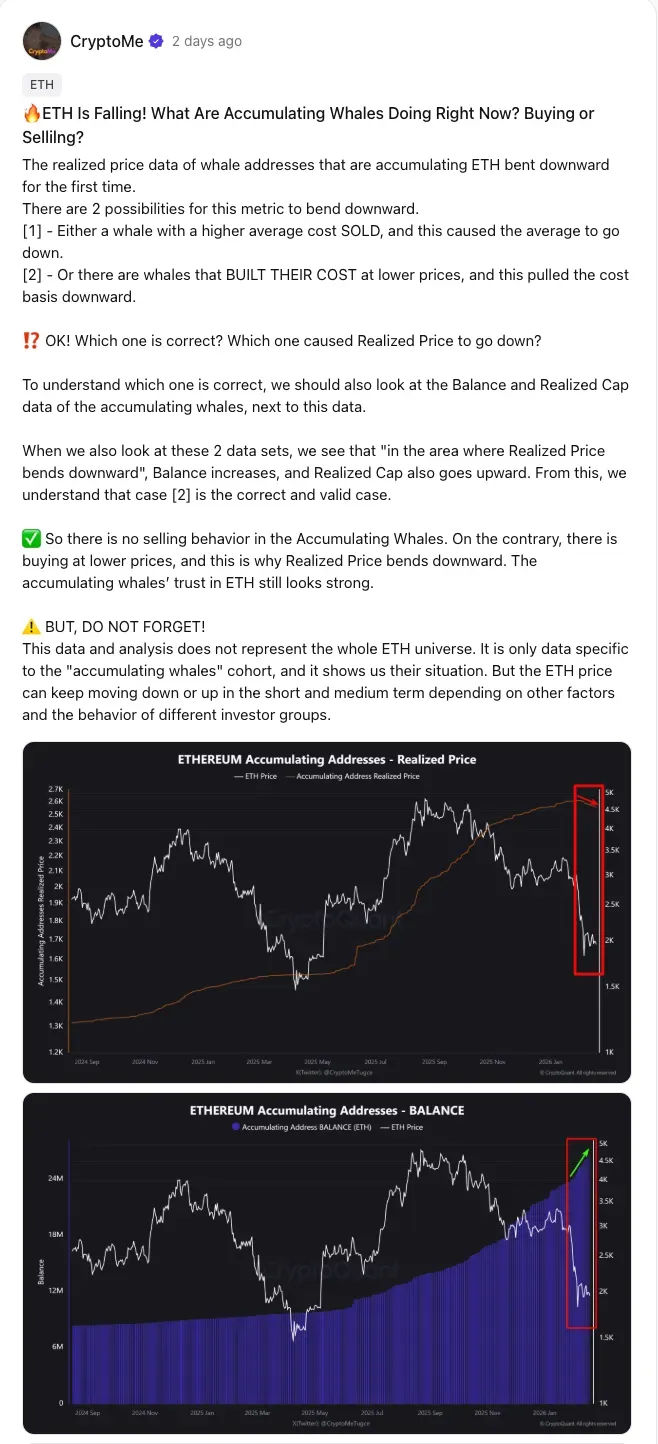

- CryptoQuant data showed Ethereum accumulating whales increased balances despite falling prices.

Bitcoin wallets that held between 1,000 and 10,000 Bitcoin rebuilt their reserves to levels not seen since the market downturn in October 2025. This is a sign of a V-shaped accumulation phase.

According to Glassnode charts, large holders increased their total balance to approximately 3.09 million Bitcoin (BTC) by the end of last year, up from 2.86 million BTC, a gain of roughly 230,000 BTC over three months, valued at $15.59 billion. It was first reported by Cointelegraph.

Glassnode data showed gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC supply over 30 days, marking the strongest pace since November 2024. Based on current exchange balances, that translates to roughly 60,000 to 100,000 BTC in accumulation over the past month, which is worth 4.07 billion to $6.78 billion at current Bitcoin prices.

Bitcoin (BTC) was trading at $68,117.64, flat over the past 48 hours. On Stockwits, the retail sentiment around BTC remained in the ‘bearish’ territory, as the chatter levels around it remained at ‘low’ over the past day.

V-shaped Recovery In Whale Balances

An analyst, Cauconomy, explained that “the entire reduction in whale reserves that occurred after October last year has now been reversed.” He added that “[this] V-shaped recovery signaled strong institutional accumulation in the last 30 days, taking advantage of falling prices and accumulating more than 98 thousand BTCs.

In late 2020 and early 2021, whale balances went from sharp distribution to rapid reaccumulation. This change happened before Bitcoin’s big continuation leg during the 2021 bull run. The current setup from late 2025 to early 2026 is similar, with big holders selling near local tops and then quickly rebuilding their positions during the pullback.

Ethereum Accumulating Whales Mirror The Pattern

Ethereum accumulation trends also drew attention from industry experts.

Fundstrat head of research Tom Lee said last week that Ethereum had historically staged V-shaped recoveries following major corrections. He noted that ETH declined by 64% from January to March of the previous year. “However, in each of the eight instances, the chart showed a V-shaped recovery. The asset rebounded 100% of the time almost as quickly as it fell,” Lee added.

Separately, a CryptoQuant contributor, CryptoMe, shared data showing that Ethereum “accumulating addresses” increased balances. Citing realized price, balance, and realized cap metrics, the contributor wrote that “there is no selling behavior in the accumulating whales,” adding that the data reflected only the accumulating cohort.

Ethereum (ETH) was trading at $1,962, up by 0.2% over 24 hours. On Stockwits, the retail sentiment around ETH moved from ‘bearish’ to ‘extremely bearish,’ as chatter levels around it remained ‘low’ over the past day.

Read also: Supreme Court Blocks Trump’s Tariffs, Tom Lee Thinks It Could Be Bitcoin’s Next Bullish Trigger

For updates and corrections, email newsroom[at]stocktwits[dot]com.<