The stock logged its worst day since June during the regular trading session, after jumping nearly 17% on Wednesday.

AES stock (AES) fell over 7% on Thursday, giving back gains from the previous session, as concerns lingered over its rumored buyout by BlackRock’s Global Infrastructure Partners.

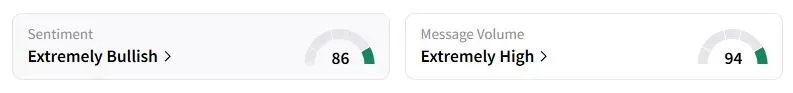

The stock logged its worst day since June during the regular trading session, after jumping nearly 17% on Wednesday. About 29.42 million shares changed hands, more than double the stock’s 200-day average trading volume. Retail sentiment on Stocktwits about AES was in the ‘extremely bullish’ territory at the time of writing, while retail message volume has surged 1,400% over the past week.

The Financial Times reported, citing sources, that GIP was poised to buy AES in a $38 billion deal, including debt, in what would be one of the largest infrastructure deals ever. BlackRock had acquired GIP for $12.5 billion the previous year, as it sought to expand its holdings in infrastructure and alternative assets.

Arlington, Virginia-based AES owns power infrastructure on four continents and produces more than 36,000 megawatts.

AES has a net debt of $29 billion, and its market valuation stood at approximately $9 billion as of Tuesday’s close, before the release of the FT report. The deal talks come amid soaring demand for electricity in the U.S., driven by energy-intensive artificial intelligence data centers. The company has already inked power supply deals with the likes of Meta, Microsoft, and Alphabet’s Google.

However, analysts wondered how much the shareholders could gain from the potential deal. “When incorporating a spread for regulatory approval, [it’s] difficult to see upside from here,” Jefferies analyst Julien Dumoulin-Smith said in a note after Wednesday’s jump. At $15/share price, the enterprise value of the deal would be $38.4 billion, above the FT-reported bid level, the brokerage said.

Separately, Barclays valued the deal at $18 per share, noting some differences in the calculation of its consolidated debt due to differing views on its cash balance from an accounting perspective. The analyst pointed out that the stock was slightly overvalued.

“It was $29 in 2021 and 2022. This was before the AI & tech deals! It better go for at least $29!” one Stocktwits user said after pointing toward the company’s earnings potential.

“Time to accumulate even more,” another user said before adding that the deal value could reach a minimum of $18.5 per share.

AES stock has gained 9.5% this year but is down over 28.5% over the past 12 months amid unfavorable policies of the Trump administration toward renewable energy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<