Adobe shares declined on Tuesday after Oppenheimer downgraded the stock to ‘Perform’ from Outperform, without a price target.

- Oppenheimer said that a challenging operating environment due to the artificial intelligence technology transition has led to “uninspiring and decelerating top-line growth.”

- However, the analyst added that Adobe has good medium-term opportunities and is a cheap stock.

- Earlier, Goldman Sachs assumed coverage of Adobe with a ‘Sell’ rating and a price target of $290.

Shares of Adobe Inc. (ADBE) declined nearly 6% on Tuesday after Oppenheimer downgraded the stock to ‘Perform’ from Outperform, without a price target, However, retail traders continue to stay bullish on the stock.

Analyst Brian Schwartz at Oppenheimer said that a challenging operating environment due to the artificial intelligence technology transition has led to “uninspiring and decelerating top-line-growth,” according to TheFly.

The analyst added that inconsistent execution with product cycles, durability concerns about the moat, lackluster investor interest for owning software names, and year-over-year operating margin guidance in FY26 will likely weigh negatively on the sentiment for the company’s opportunities this year, and limit near-term upside for the shares.

Shares of ADBE were trading around $308.06 at the time of writing, the lowest it has been in over three years.

Street Consensus

Oppenheimer had previously been bullish on Adobe, expecting its AI business to boost growth in its digital media segment. However, the analyst noted that it did not play out as expected and growth in the digital media growth decelerated further in FY25.

However, the analyst added that Adobe has good medium-term opportunities and is a cheap stock.

Earlier, Goldman Sachs assumed coverage of Adobe with a ‘Sell’ rating and a price target of $290. The analyst noted that Adobe’s high-end seat count is under pressure as value accrues at the low-end where the company has minimal exposure.

Adobe’s consensus rating, which indicates the ratio of buy, hold, and sell ratings from analysts, is at 3.73, down from 4 in December 2025, as per data from Koyfin. 22 of 40 analysts still have a rating of ‘Buy’ or higher on the stock.

How Are Stocktwits Users Reacting?

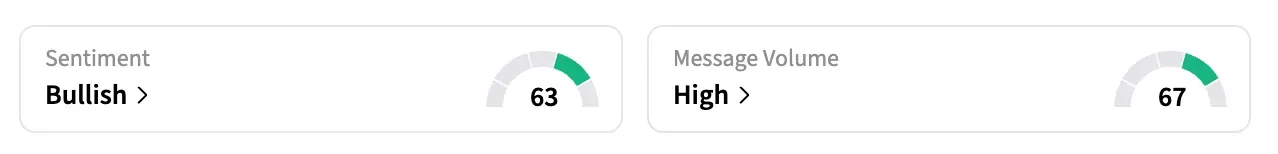

On Stocktwits, retail sentiment around ADBE stock jumped to ‘bullish’ from ‘bearish’ territory over the past 24 hours amid ‘high’ message volumes. Despite the downturn, some retail investors are still bullish on the stock, seeing an attractive long-term opportunity.

One user called Adobe ‘the best creative software in the market’, adding that they would be buying more shares.

Another bullish user pointed out that the company has been increasingly buying back its own shares, indicating its confidence.

Shares of ADBE are down over 24% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<