The Adani Group, India’s largest infrastructure player, today announced the financial performance of the Adani Portfolio for the Trailing-Twelve-Month (TTM) and Q1FY26, along with its Credit performance.

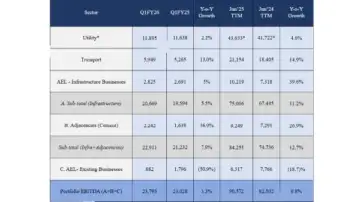

The Adani Portfolio EBITDA has crossed the INR 90,000 crore milestone on a trailing twelve-month basis for the first time, with Q1 EBITDA also reaching a record high. This strong performance was led by sustained growth in incubating businesses (notably Airports under AEL), along with Adani Green Energy, Adani Energy Solutions, Adani Ports & SEZ, and Ambuja Cements. Robust contributions from these businesses more than offset the dip in AEL’s existing. Negative growth in AEL Existing Business is primarily due to a decrease in trade volume and volatility of index prices in IRM (Integrated Resource Management). Sustained EBITDA expansion provides strong support for the planned annual capital expenditure of INR 1.5-INR 1.6 lakh crore.

On the credit side, the portfolio-level leverage continues to remain one of the lowest globally at 2.6 times Net Debt to EBITDA, while high liquidity of INR 53,843 crore is maintained in cash.

*Company-wise Key Highlights for Q1FY26:

- *Adani Enterpriss'(AEL),* incubated businesses are on a high-growth path:

- – ANIL has successfully commissioned India’s first off-grid 5 MW Green Hydrogen pilot plant.

- – Pax movements up by 3% YoY to 23.4 Mn in Q1FY26 & Cargo movements up by 4% YoY to 0.28 MMT in Q1FY26.

- – *Adani Green Energy’s(AGEL)* operational capacity increased by 45% YoY to 15,816 MW with the addition of solar and wind power plants.

- – *Adani Energy Solutions (AESL)* secured one new transmission project – WRNES Talegaon line.

- – *Adani Ports & SEZ’s (APSEZ*) volume grew +11 % YoY to 121 MMT in Q1FY26.

- – *Adani Cements’ (Ambuja)* present Cement Capacity of ~105 MTPA.