New Delhi: Adani Group on Friday exited AWL Agri Business (formerly known as Adani Wilmar) by selling its remaining 10.42 per cent stake in the company for Rs 3,732 crore through open market transactions, according to the BSE data.

Adani Commodities LLP (ACL), a subsidiary of Adani Enterprises, offloaded a total of 13,54,82,400 equity shares in 11 tranches on Friday, amounting to a 10.42 per cent stake in AWL Agri Business, as per the block deal data on the BSE.

The transaction was valued at around Rs 3,732.54 crore and executed at an average price of Rs 275.50 apiece.

Meanwhile, Dubai-based Shajaeatan Investment FZCO purchased a little over 11.07 crore equity shares, or 8.52 per cent in AWL Agri Business for Rs 3,049.99 crore.

Quant Mutual Fund (MF), IDFC MF, Bandhan MF, Jupiter Fund Management, Morgan Stanley Asia Singapore, US-based Susquehanna International Group, Franklin Templeton, Vanguard, and Singapore-based Duro Capital were among the buyers of AWL Agri Business shares on the BSE.

Shares of AWL Agri Business slipped 1.31 per cent to close at Rs 274.60 apiece on the BSE.

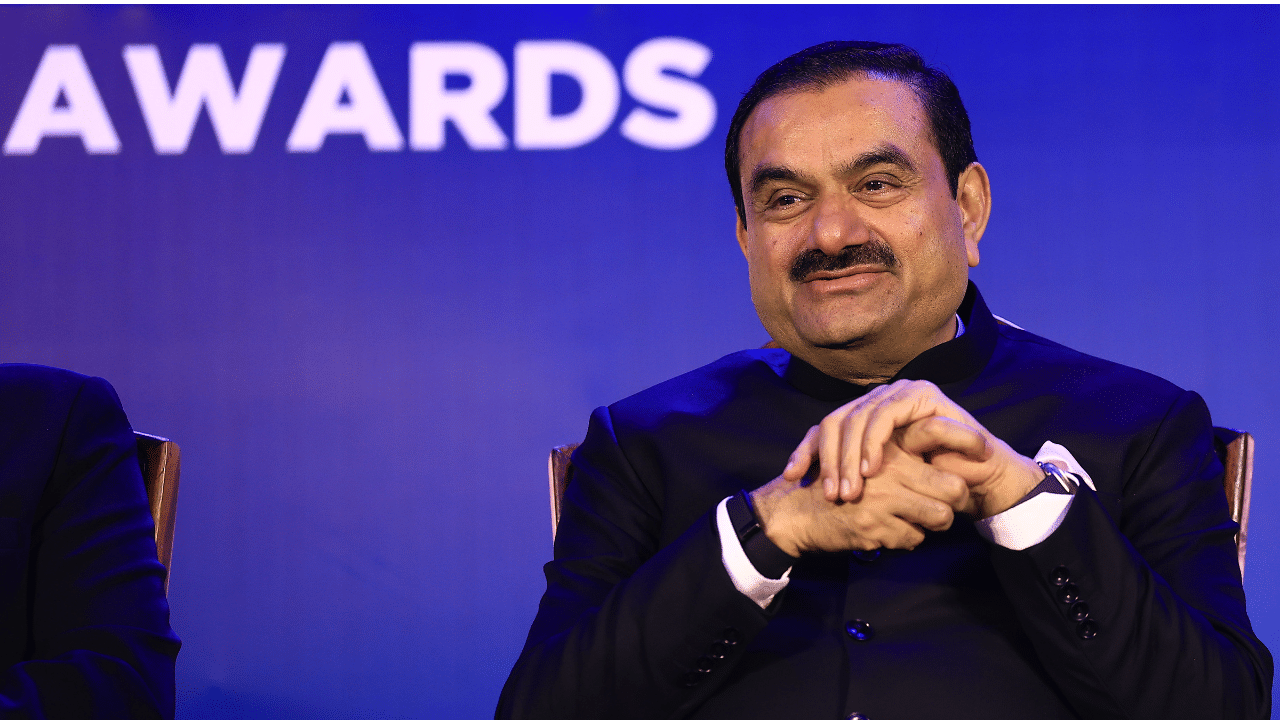

On Thursday, billionaire Gautam Adani-promoted Adani Group said it has sold a 20 per cent stake in AWL Agri Business to Wilmar International Singapore for Rs 7,150 crore, as part of its decision to exit the FMCG business and focus on the infrastructure vertical.

In January, ACL had already sold a 13.51 per cent stake in AWL through the offer for sale route, generating Rs 4,855 crore.

AWL Agri Business sells edible oil and other food products under Fortune brand.

In December last year, Adani Group had announced divestment of its entire 44 per cent stake in AWL to sharpen its focus on core infrastructure businesses.

During the 2024-25 fiscal, AWL Agri Business Ltd had posted a net profit of Rs 1,225.81 crore on a total income of Rs 63,910.28 crore.