The company said AI demand is now embedded across its broader transformation work as it shifts reporting practices.

- The company said isolating advanced AI figures is no longer meaningful because AI is now integrated across most client engagements.

- Advanced AI bookings totaled $2.2 billion in the quarter, with revenue of about $1.1 billion.

- The company forecast second-quarter revenue of $17.35 billion to $18 billion, with the midpoint below expectations.

Accenture (ACN) shares slipped on Thursday following comments by the company implying it will stop breaking out standalone “advanced AI” bookings and revenue, with CEO Julie Sweet telling analysts that “this will be the last quarter” the metric is disclosed.

The IT consulting firm made the comments during its fiscal first-quarter 2026 earnings call on Thursday, even as it reported another quarter of growth in advanced AI-related work.

At the time of writing, the stock declined 2.2% to $267.65.

End Of Standalone AI Disclosure

Sweet said Accenture will no longer separately report bookings and revenue from advanced AI, which it defines as generative AI, agentic AI and physical AI, excluding data, classical AI and robotic process automation.

She said Accenture introduced the metric in the third quarter of fiscal 2023, shortly after generative AI emerged, to size the opportunity and demonstrate early leadership. Since then, Accenture has consistently reported the figures.

“This will be the last quarter in which we shared these specific metrics,” Sweet said.

She said the decision reflects how advanced AI is now embedded across nearly everything Accenture does, making it less meaningful to isolate the data as a standalone category. Sweet said client demand has shifted toward scaled, end-to-end solutions that integrate multiple forms of AI, rather than isolated projects.

AI Bookings And Revenue Reach New Levels

In the first quarter (Q1), Accenture reported advanced AI bookings of $2.2 billion, nearly doubling from the same quarter last year and rising from the previous quarter. Revenue from advanced AI reached about $1.1 billion, the company said.

Sweet said that since Accenture began reporting the metric, it has delivered about $11.5 billion in advanced AI bookings across 11,000 projects, with cumulative revenue of $4.8 billion.

She said advanced AI is increasingly embedded in large transformation programs, either enabling future enterprise use or being implemented directly as part of client solutions.

Q1 Review

Accenture reported first-quarter fiscal 2026 revenue of $18.74 billion, above analysts’ estimates of $18.52 billion, while adjusted diluted earnings per share came in at $3.94, topping expectations of $3.74.

The professional services firm said revenue grew 5% in local currency and landed at the top of its guided range, with bookings of $20.9 billion and a book-to-bill ratio of 1.1.

Adjusted operating margin expanded 30 basis points year over year to 17%, and free cash flow totaled $1.5 billion, with $3.3 billion returned to shareholders through share repurchases and dividends during the quarter.

For the second quarter, Accenture forecast revenue in the range of $17.35 billion to $18 billion, below analysts’ expectations of $17.78 billion at the midpoint.

How Did Stocktwits Users React?

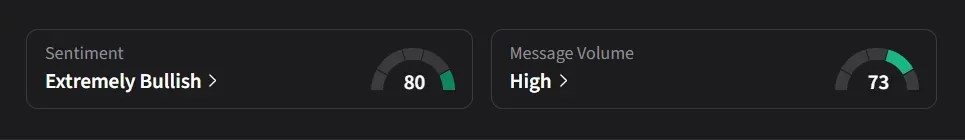

On Stocktwits, retail sentiment for Accenture was ‘extremely bullish’ amid ‘high’ message volume.

One user called the dip a “buy low opportunity”

Another user expressed a bearish view, stating, “They’re stopping the “Advanced AI bookings/revenue” disclosure.”

Accenture’s stock has declined 22% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<