Since going public, the stock has swung wildly, trading as low as $10 and as high as $93 in just two days.

- Virtuix officially began trading on the Nasdaq Global Market on Tuesday.

- On Wednesday alone, shares fell more than 56%, sliding from around $24 to close near $11.

- For the six months ended Sept. 30, 2025, the company’s revenue surged roughly 138% year over year.

Virtuix Inc. (VTIX) has emerged as one of the most closely watched names in the virtual reality space on Thursday, after its recent public debut sparked sharp price swings.

The company officially began trading on the Nasdaq Global Market on Tuesday. Since going public, the stock has swung wildly, trading as low as $10 and as high as $93 in just two days. On Wednesday alone, shares fell more than 56%, sliding from around $24 to close near $11.

Virtuix stock traded over 58% higher in Thursday’s premarket.

What Are Stocktwits Users Saying

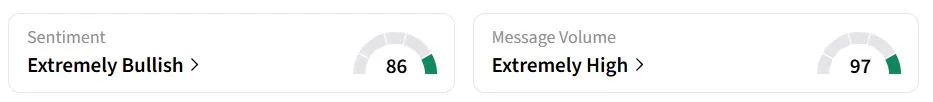

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

Stocktwits users point to a relatively small number of freely tradable shares, a condition that can exaggerate price movement when buying pressure increases. That setup has fueled discussion around the possibility of a short squeeze, a scenario in which bearish traders rush to cover positions, potentially pushing shares higher.

Growth Trajectory

For the six months ended Sept. 30, 2025, revenue surged roughly 138% year over year, driven in part by the rollout of its next-generation home gaming system, Omni One. To date, Virtuix has shipped three product generations and recorded more than $20 million in lifetime sales.

In contrast, at the time of listing, the company was valued at $341 million.

“Going public provides us with access to capital to fund our growth and develop new products like Virtual Terrain Walk, our training system for the defense sector.”

-Jan Goetgeluk, Founder and CEO, Virtuix

Virtuix locked in an $11 million commitment from Chicago Venture Partners and secured up to $50 million in additional equity financing. Funds are earmarked to expand the marketing and distribution of Omni One, backed by manufacturing capacity to build 3,000 units per month, a run rate that could translate into approximately $100 million in annual revenue potential.

What Does This VR Maker Do?

Founded in 2013, Virtuix makes full-body virtual reality equipment used by consumers, businesses, and military organizations.

Its main products, known as Omni treadmills, let users move freely in all directions while walking or running inside video games and other virtual reality experiences.

For updates and corrections, email newsroom[at]stocktwits[dot]com.