Markets remained firm for the seventh consecutive day, with selective buying in energy, media, and financials. Analyst calls pointed to caution in the BSE and OFSS, despite bullish retail sentiment.

Indian equity markets gained for the seventh consecutive session, with the Nifty reclaiming the 25,000 mark. Commerce Minister Piyush Goyal stated that he was confident the first tranche of the US-India trade deal would be finalized by November.

On Thursday, the Sensex closed 123 points higher at 81,548, while the Nifty 50 ended up 32 points at 25,005. Broader markets mirrored the optimism but gave up gains by close, with the Nifty Midcap and Smallcap indices ending flat.

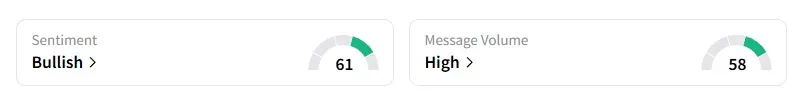

The retail investor sentiment surrounding the Nifty 50 was ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, autos, IT, and consumer durables saw some selling pressure. Meanwhile, energy, media, and financials ended in the green.

PSU banks gained for the second session ahead of the upcoming meeting between PSB chiefs and government officials that is scheduled to begin tomorrow to discuss reforms and consolidation plans.

Tega shares ended 3% lower after it announced a deal to acquire Molycop for $1.5 billion. Concerns over fundraising for this buyout weighed on investor sentiment.

Aurobindo Pharmaceuticals ended nearly 6% higher after news reports indicated that private equity firm GTCR has struck a $4.8 billion deal to acquire Zentiva. Aurobindo was one of the contenders in this race for the Zentiva buyout.

BSE, Angel One, and Nuvama shares took a knock of over 4% on reports that the market regulator has floated a consultation paper on ending weekly F&O contracts within a month.

Analyst Rajneesh Sharma highlighted that BSE stock broke down from an ascending channel that had been in place since late 2023, signaling a weakening in the overall trend structure as prices slipped below the critical support trendline. It formed a double top pattern with resistance developing around ₹2,900–₹3,000, and the subsequent breakdown from the neckline suggested potential for a bearish reversal.

Going ahead, resistance is seen at ₹2,250 and ₹2,577, which align with previous breakdown zones. On the downside, supports are identified at ₹2,084, which acted as a recent bounce zone, followed by ₹1,950 and the confluence zone between ₹1,600–1,700. Sharma said that currently, no signs of a bullish reversal are visible, making it crucial for buyers to hold the ₹2,000–2,084 support region to prevent further downside risks.

Neuland Labs hit a nine-month high on strong buying momentum.

Stock Calls

Oracle Financial (OFSS) shares closed 2% lower, following a clarification from the company stating that Oracle Corporation’s results announcement does not directly affect its business operations. Analyst Mayank Singh Chandel noted that the rally in OFSS was driven mainly by Oracle’s global guidance, which benefits investors seeking cloud and AI exposure through Oracle’s group companies. The stock has been in a downtrend since December last year, but from April 2025, it started moving up again. In June, it reversed from a resistance zone between ₹10,080 and ₹9,730. Since sellers are active around the resistance level, he advised traders to wait for a confirmed close above ₹10,080 before making any fresh entry.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <