The company’s Q3 revenue of $1.74 billion and adjusted earnings per share of $3.39 both came in below the analysts’ consensus estimate of $1.77 billion and $3.75, according to Fiscal AI data.

Synopsys Inc. (SNPS) stock tumbled 34% on Wednesday after the firm posted downbeat earnings and multiple Wall Street firms revised their price targets on the chip design software company, citing the disappointing third-quarter (Q3) performance and persistent concerns about its intellectual property (IP) segment.

The company’s Q3 revenue of $1.74 billion and adjusted earnings per share (EPS) of $3.39 both came in below the analysts’ consensus estimate of $1.77 billion and $3.75, according to Fiscal AI data.

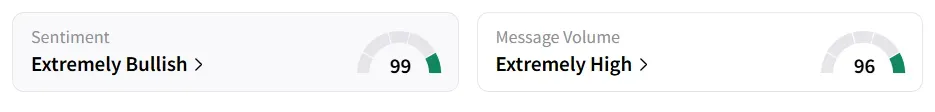

Retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 2,883% increase in user message count in 24 hours. A bullish Stocktwits user called the stock’s fall ‘overreaction’.

Another user said they have initiated a position.

Rosenblatt analyst Blair Abernethy downgraded Synopsys from ‘Buy’ to ‘Neutral’ and cut the firm’s price target from $650 to $605. Abernethy noted that the company’s IP pivot will take several quarters to stabilize, which evokes heightened risk.

The analyst also cited management’s explanation, which involved China export constraints, foundry-related slowdowns, and underperforming IP product strategies, as contributing factors to the miss.

Needham analyst Charles Shi also lowered the price target to $550 from $660, but maintained a ‘Buy’ rating. Shi labeled the quarter as “mixed,” with the IP business showing unexpected weakness.

Stifel analyst Ruben Roy echoed those concerns, trimming the target to $550 from $650 while keeping a ‘Buy’ stance. Roy said the IP drag was mostly due to cautious behavior from Chinese clients after U.S. export regulations took effect, combined with Intel (INTC)-related opportunities that failed to materialize.

Synopsys’ stock has lost over 17% in 2025 and over 13% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.